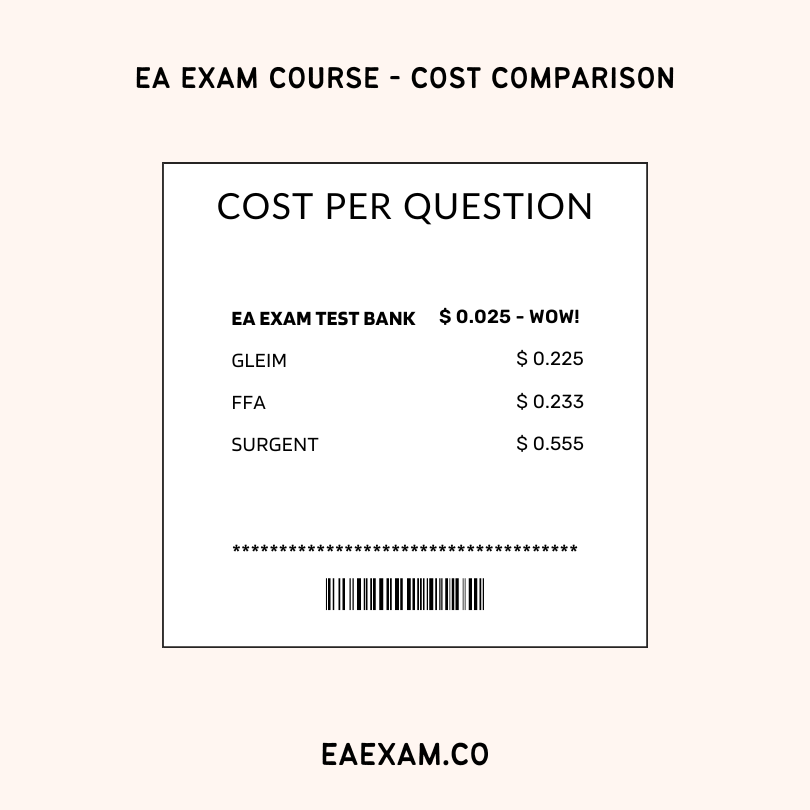

A Better Value, Period.

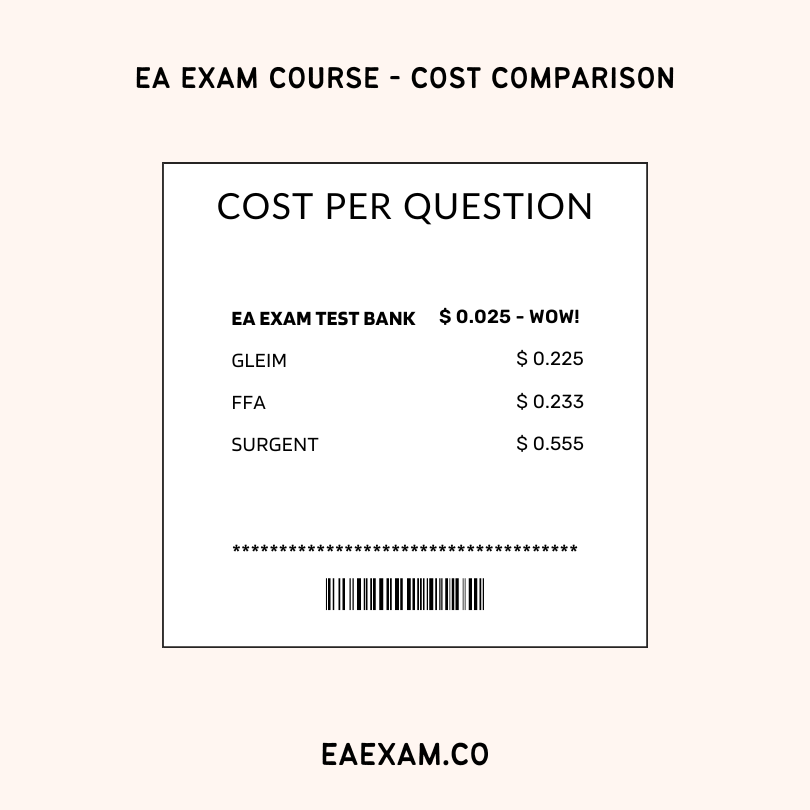

Unearth exceptional value for your IRS SEE prep, presenting practice questions at a mere $0.025 each—10x more affordable than rivals. Choose EA Exam Test Bank and amplify your study prowess while keeping your budget intact!

EA Exam Test Bank provides thousands of IRS practice questions and exams, turbocharged by A.I., along with study guide content and analytics. We guarantee you’ll pass on the first attempt!

Bundle & Save

or Buy in Parts

to Meet Any Budget!

Test Bank

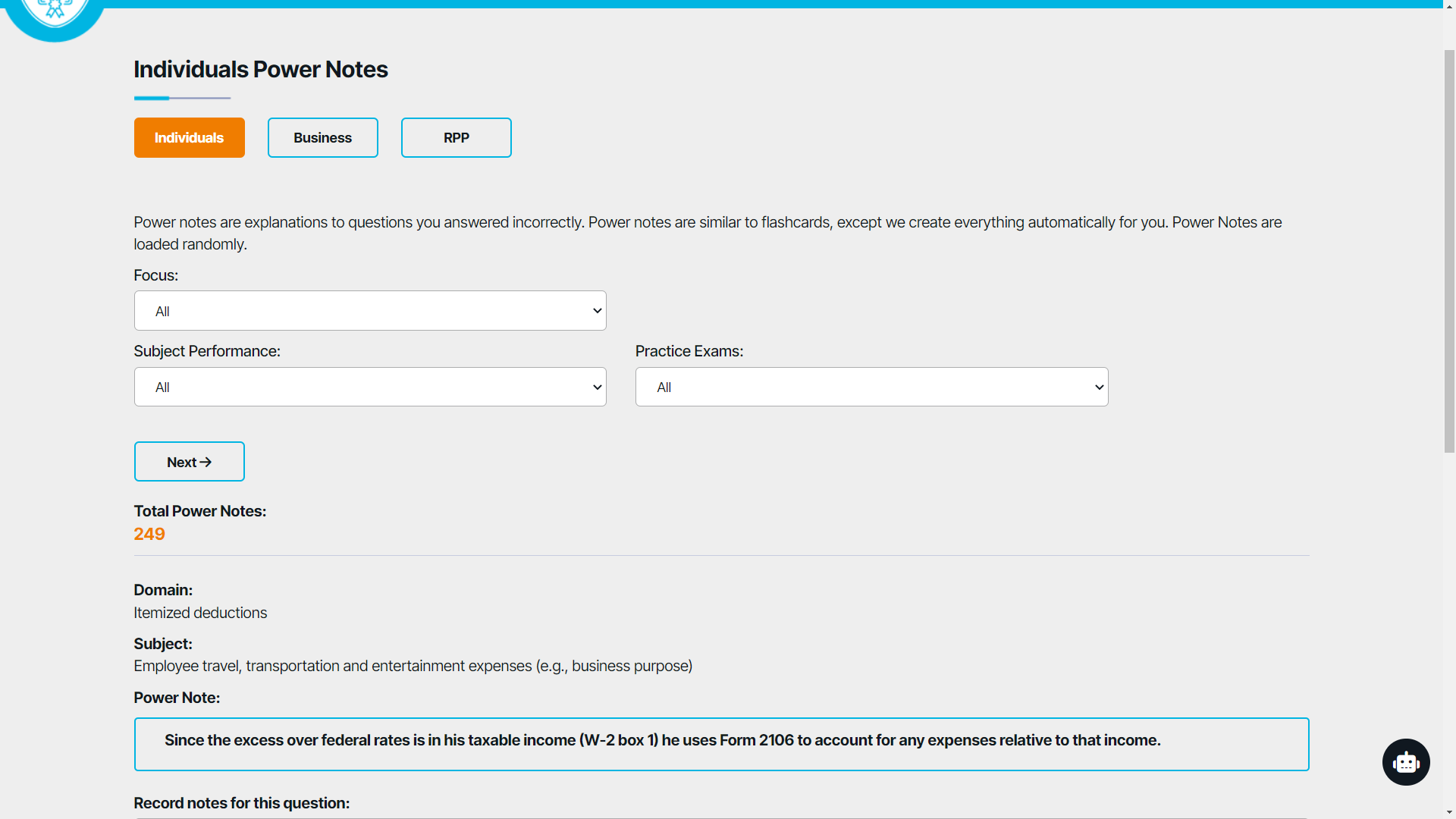

Power Notes

Practice Exams

All 3 Parts, Unlimited

10,000+ Questions

Test Bank

Power Notes

Practice Exams

Study Guide

AI Tutor

All 3 Parts, Unlimited

10,000+ Questions

Send a text message to (407) 917-0818 or click the chat icon in the lower right corner of the page.

Customer service and your satisfaction are extremely important to us. Please feel free to contact us anytime with any questions or comments and we will respond ASAP!

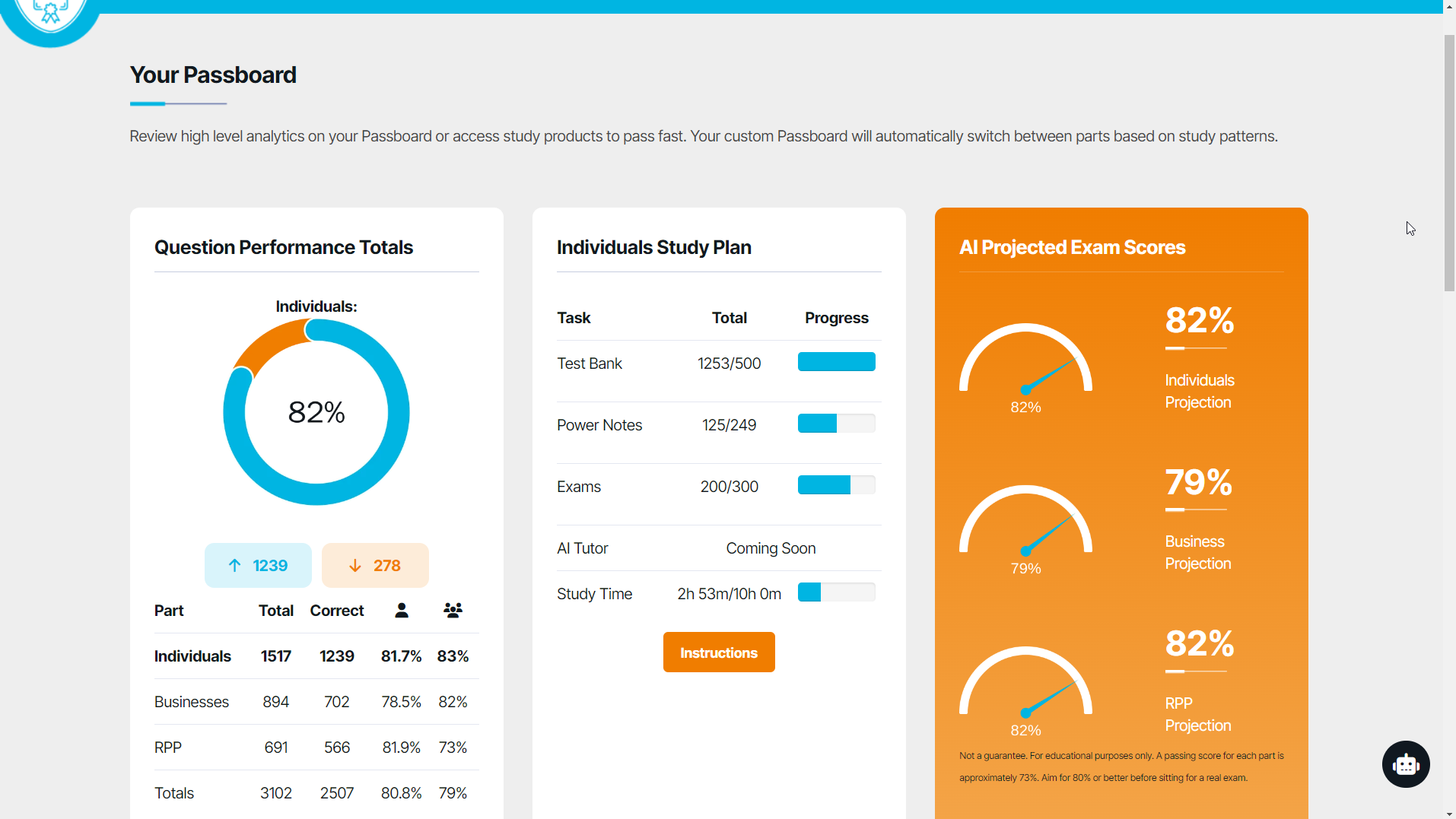

All tools include Question Performance, Dynamic Study Plan, AI Projected Exam Scores, Subject Opportunities, Time Performance, Community Performance, Money Bank Guarantee, Pass Guarantee, Unlimited Access, Free Updates, & More.

Achieve success in your exams with our comprehensive study toolkit, carefully designed to help you master the exam material and pass the Enrolled Agent exam. Take this chance to speed up your exam preparation and confidently tackle the IRS SEE!

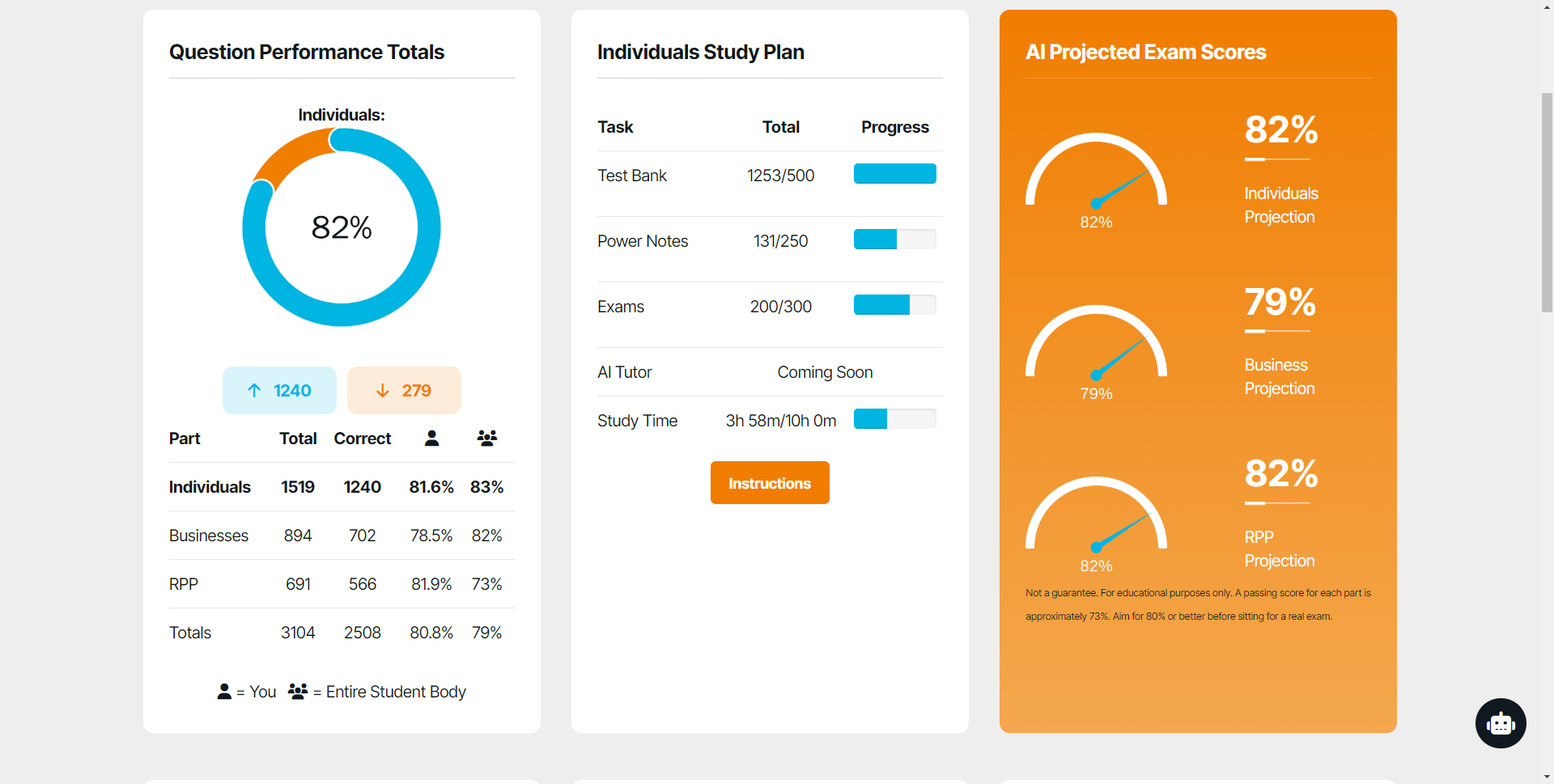

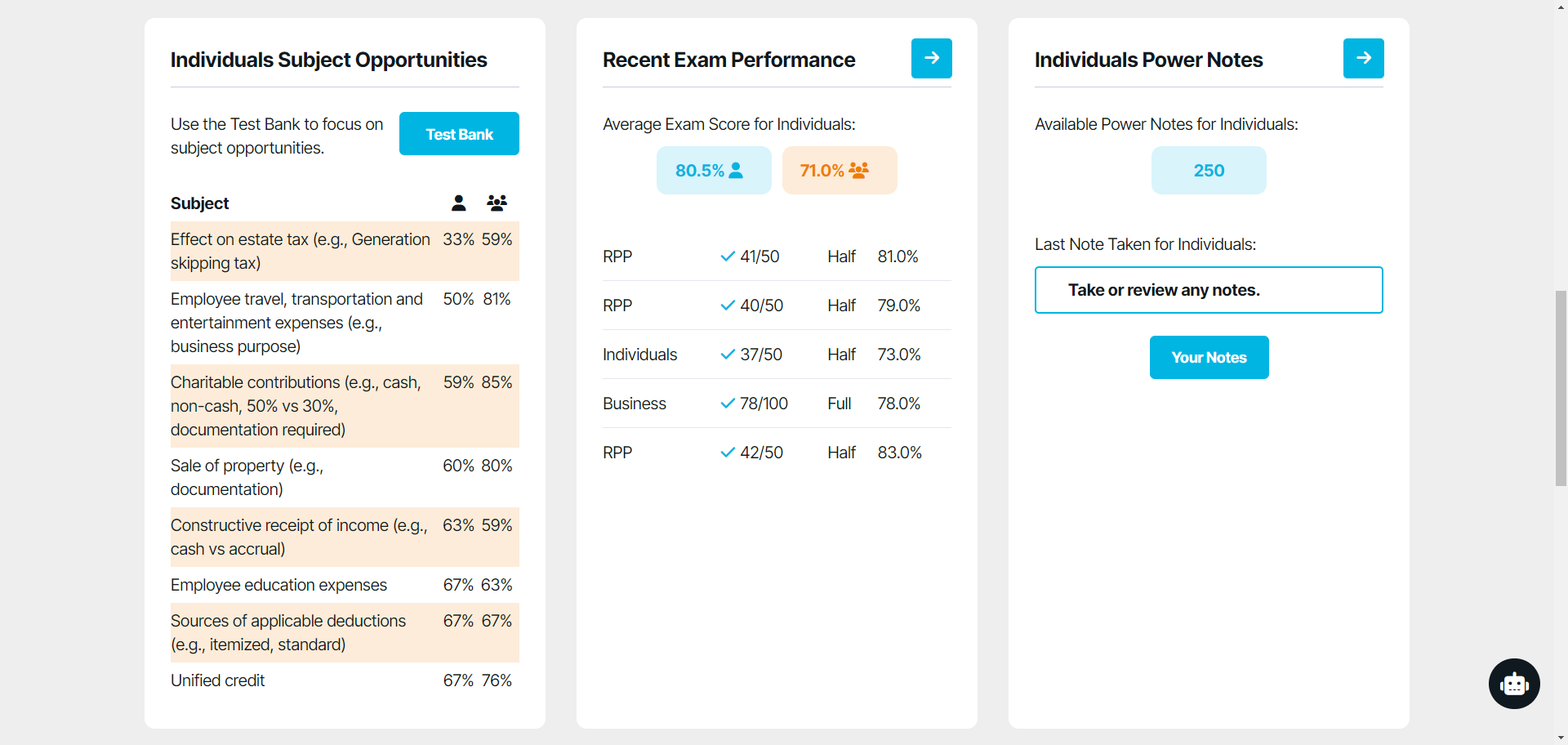

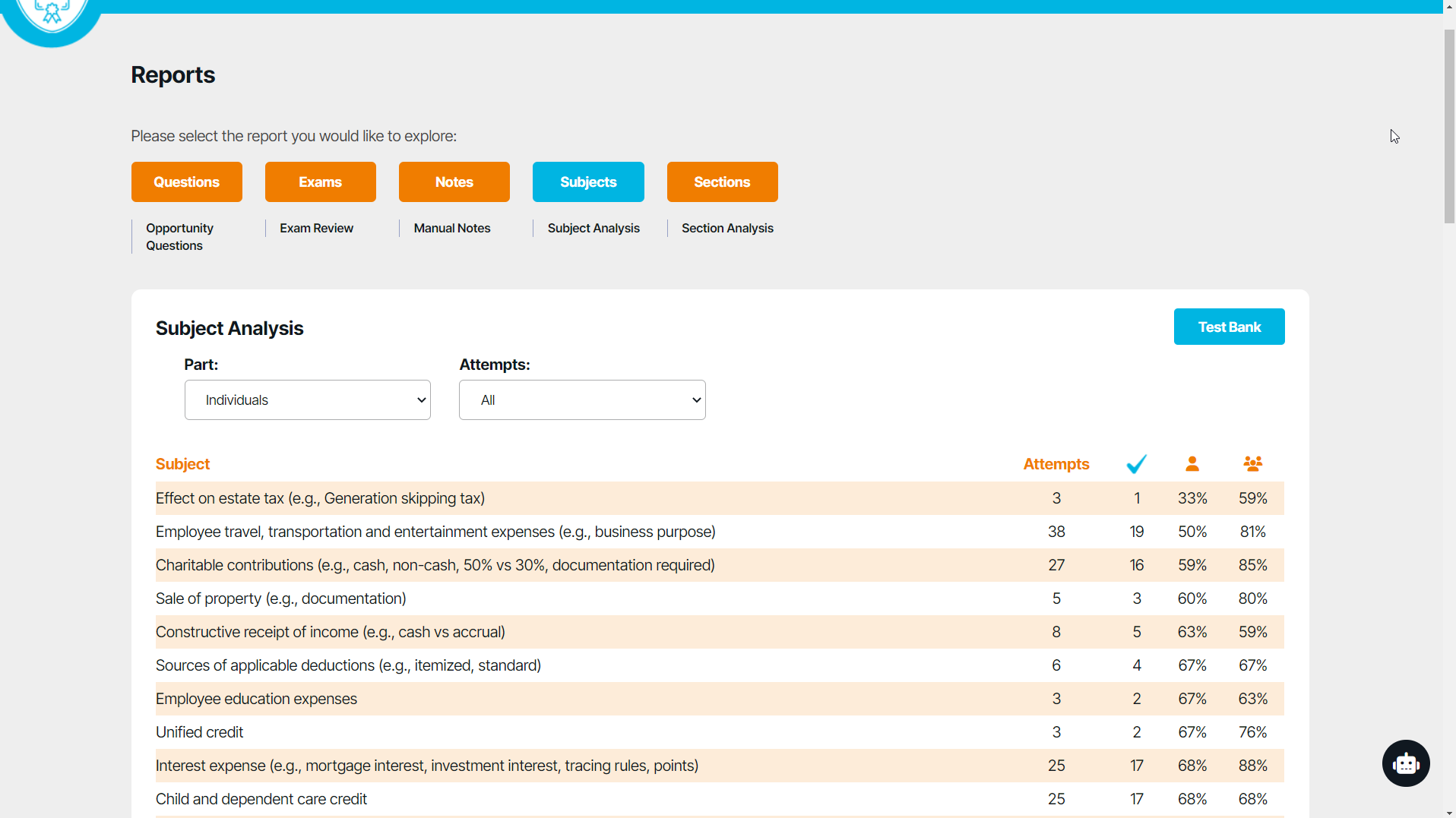

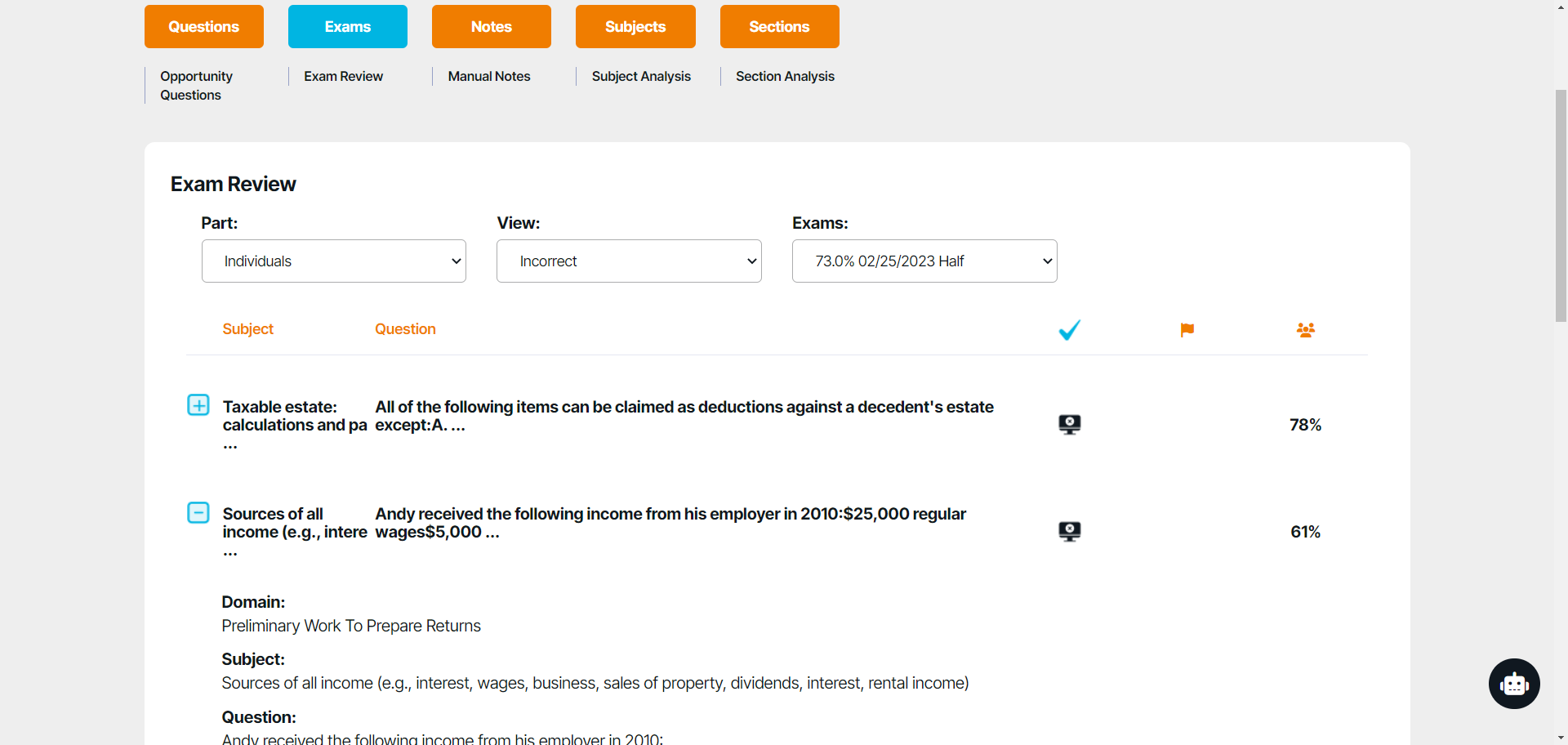

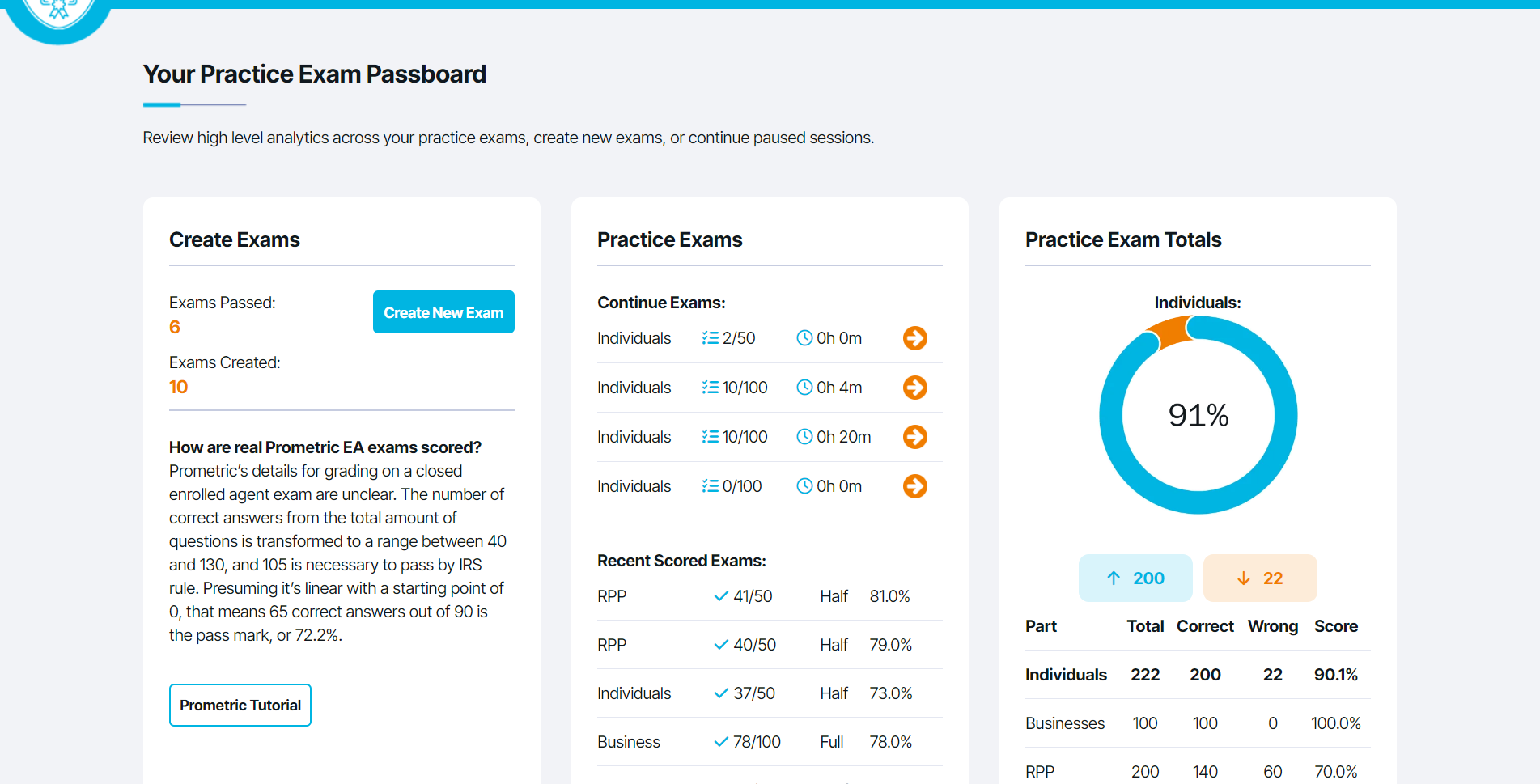

High level data and analytics to give you an edge on the SEE with a dynamic study plan, AI projected exam, score, community performance, and much more.

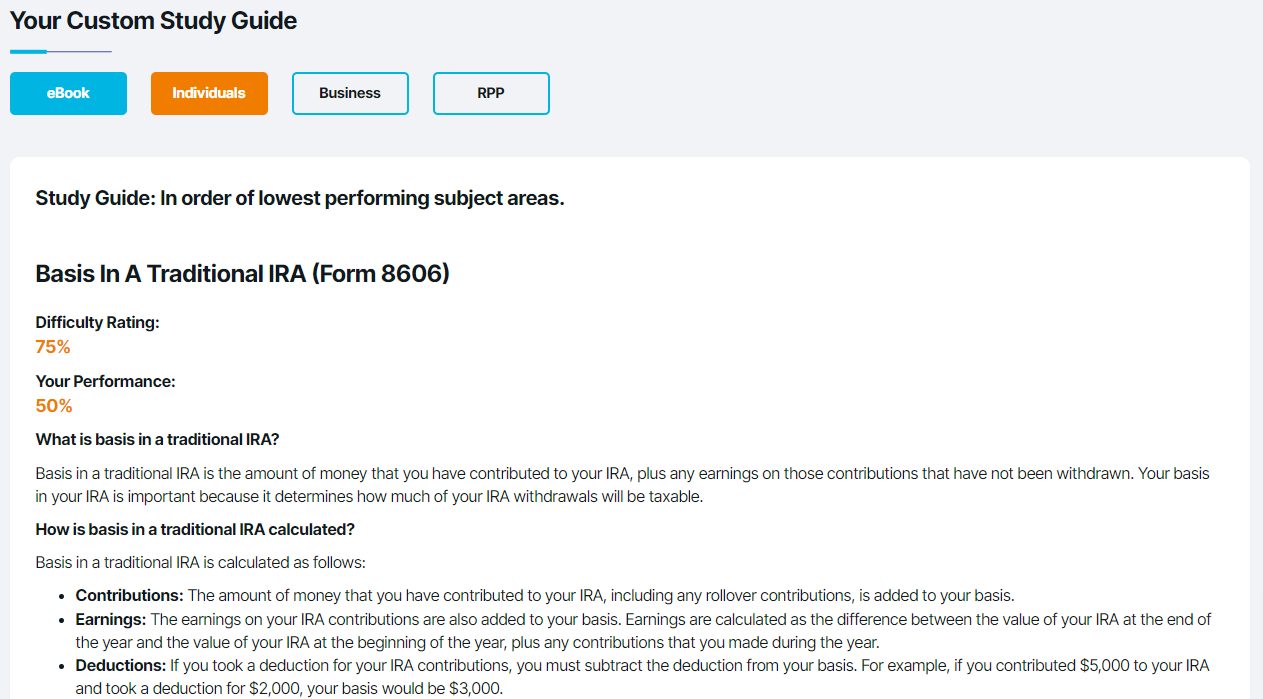

Get ready to pass the IRS SEE with the 'Comprehensive Enrolled Agent Exam Study Guide (Parts 1-3).' This complete guide is carefully made for students who want to become an Enrolled Agent (EA) on their first attempt.

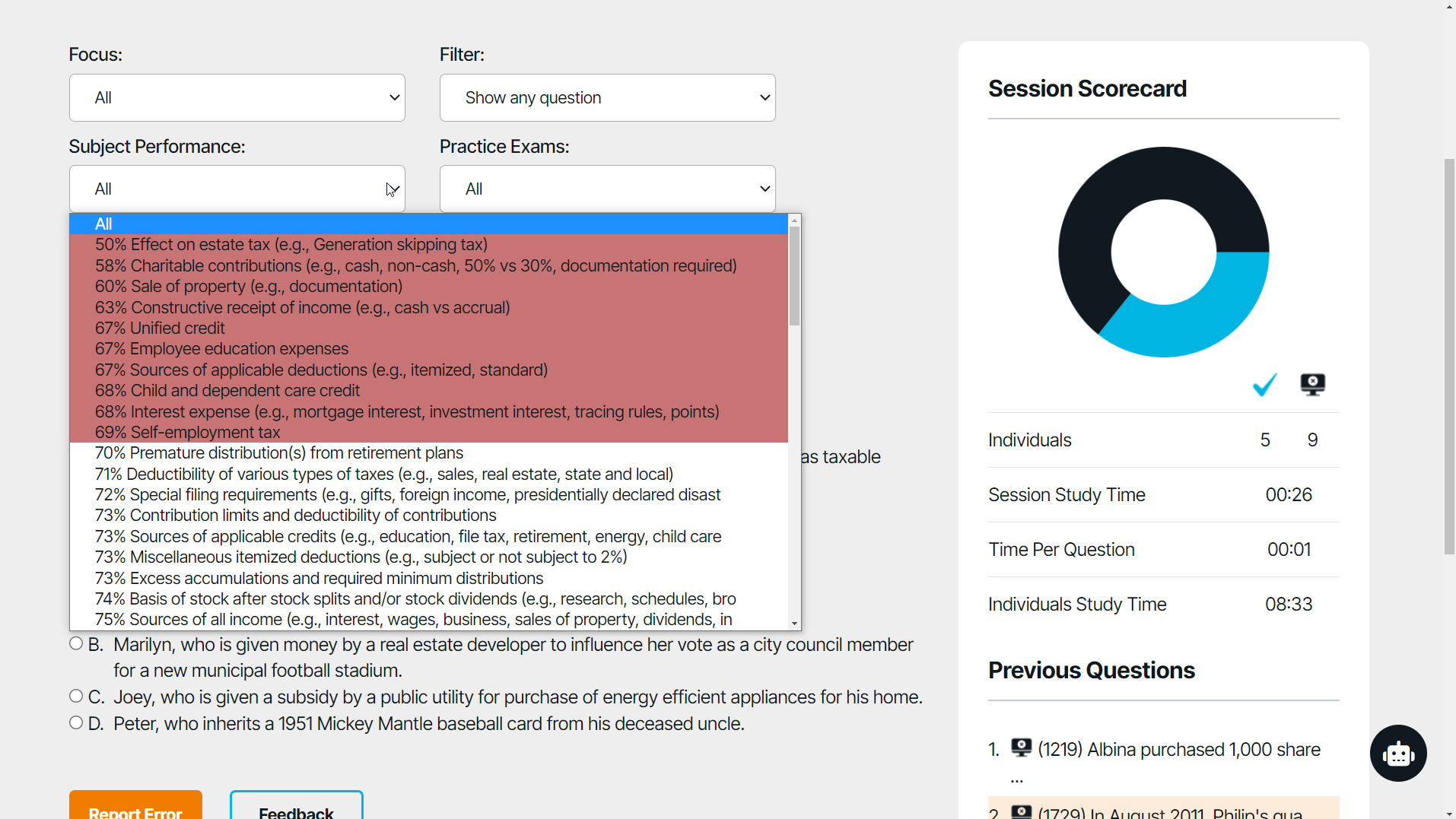

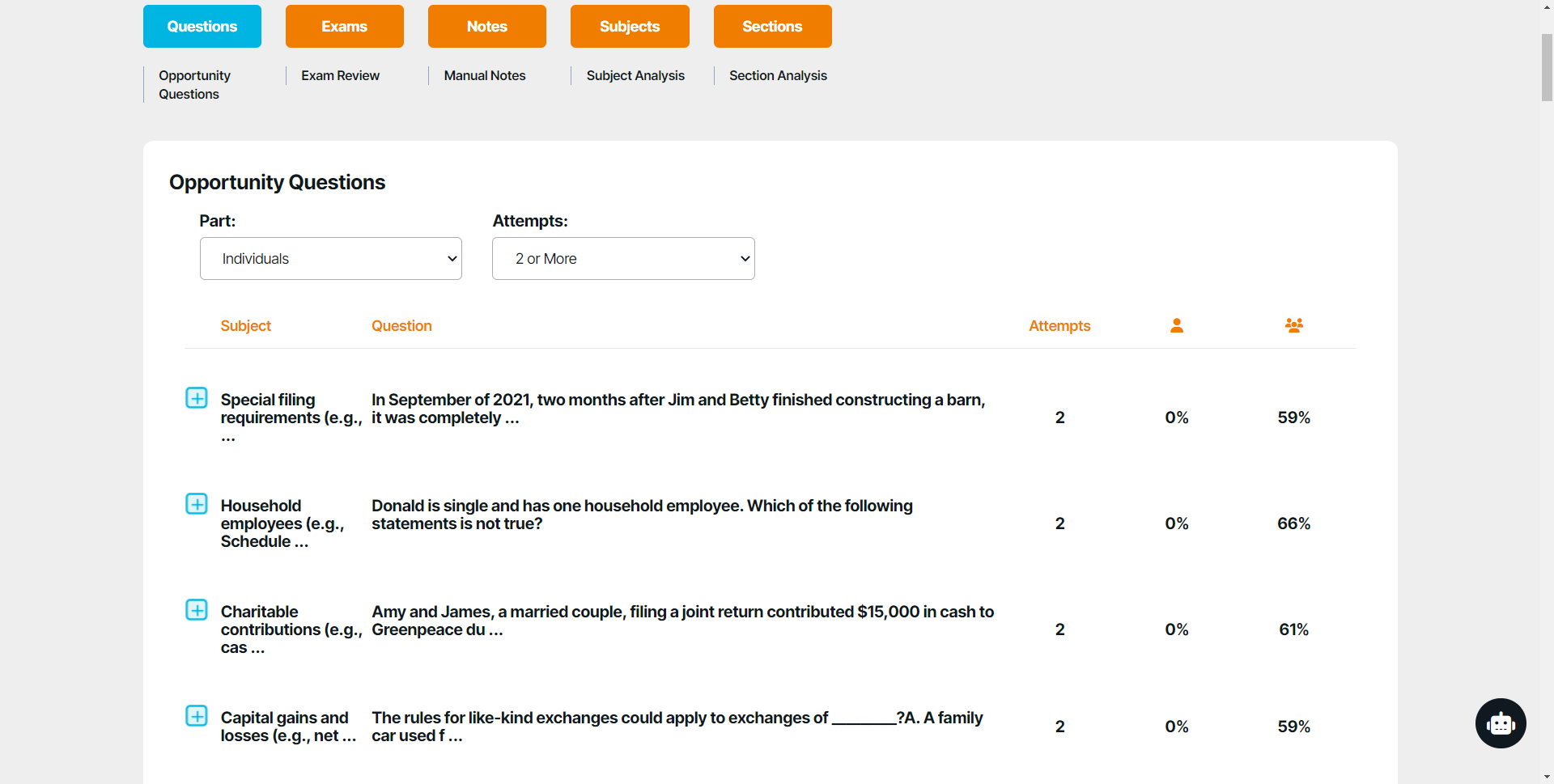

Over 10,000 questions across exam domains with the ability to attack weak subject areas, review practice exams, and view detailed explanations.

A dynamic combination of flashcards and custom tax code content based on opportunities that will improve your exam performance.

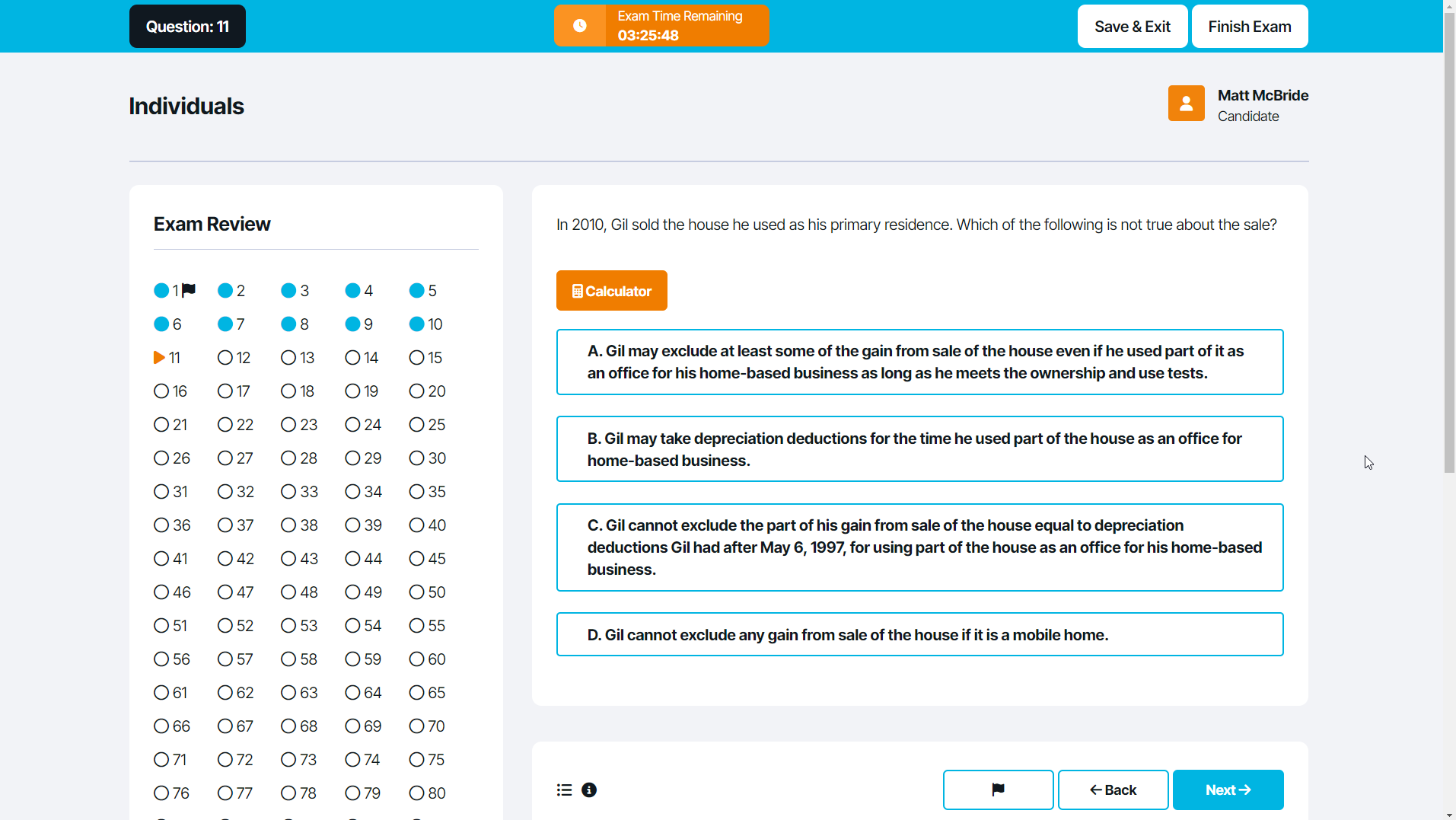

Full or mini practice exams that area weighted, timed, scored, and built to function exactly the like real thing.

Unearth exceptional value for your IRS SEE prep, presenting practice questions at a mere $0.025 each—10x more affordable than rivals. Choose EA Exam Test Bank and amplify your study prowess while keeping your budget intact!

Our ChatGPT AI EA exam tutor is available 24/7/365 to provide instant, genius level assistance. Our Pass Bot consistently scores 100% on practice exams. If you don’t believe us, sign up no for free and ask up to 10 questions.

Every test question is tied to a subject covered on the exam. Based on question performance we can pinpoint exact subjects to invest time studying while also showing how you stack up to our community – pass faster!!

EA Exam Test Bank delivers an unparalleled learning experience for aspiring Enrolled Agents, offering a comprehensive course with over 10,000 practice questions and advanced AI technology. Our personalized approach, including custom flashcards and targeted reading materials, coupled with superior analytics, drives success and enables students to pass on their first attempt. Invest in your future with our exceptional value and gain an edge in your Enrolled Agent exam preparation journey.

An enrolled agent is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service. Like attorneys and certified public accountants (CPAs), enrolled agents are generally free to represent a wide range of taxpayers, handle a variety of tax matters, and represent clients before any IRS office.

To become an EA, follow these steps:

*Some former IRS employees may be exempt from the exam requirement due to their past technical experience.

To get started, review the EA exam prep Candidate Information Bulletin.

Test fees are non-refundable and non-transferable. $203 fee per part must be paid at the time of appointment scheduling.

There are three parts to the SEE:

There are 100 questions in each part of the SEE.

Each part requires the 100 questions to be answered within 3.5 hours. The actual seat time is 4 hours as there will be a tutorial, a survey, and a scheduled 15-minute break for each part.

The simple answer is the tax law used to file your personal or business tax returns. So, any tax law passed by December 31 in the previous year unless otherwise stated. All questions refer to the previous calendar year, unless otherwise stated. Questions containing the term “current year” refer to the previous calendar year. Candidates should not take into account any legislation or court decisions after December 31 of the previous year when answering questions.

Exams can be taken in any order.

The testing window runs from May 1 to the end of February, and each exam part may be taken four times. With the correct EA exam prep you should pass each on the first attempt.

Tests are offered from May 1 to the end of February of the following year. They are not offered during the annual blackout period in March and April when the exams are reviewed and updated.

It is possible to schedule an examination appointment either through Prometric.com/see, by calling 800-306-3926 (toll-free) or 443-751-4193 (toll) on weekdays between 8am and 9pm ET, or by completing Form 2587. Payment for the exam must be made at this time and MasterCard, Visa, and American Express are all accepted. For those using Prometric.com/see to register, you must create a user profile first – refer to the “What’s New” job aid for more information on this step.

It is possible to reschedule your appointment online or by phone. You will need your confirmation number in order to do so. You can contact Prometric online or by calling 800-306-3926 (toll-free) or 443-751-4193 (toll) on weekdays between 8am and 9pm ET.

Generally, cancellations will not be refunded. Rescheduling fees will apply as follows:

Special Enrollment Exam (SEE) international testing is available for the dates and locations below. Candidates can schedule their exams online or call 800-306-3926 (toll-free) or +1 443-751-4193 (toll), Monday through Friday, 8 a.m. – 9 p.m. (ET).

A passing score can generally be carried over for two years from the date the candidate passed that part of the examination. Due to the global pandemic, the two-year testing period has been extended to three years in order to provide candidates with flexibility in testing while allowing more time for EA exam prep.

Candidates who pass a part of the examination can retain passing scores for up to three years from the date that section was cleared. For instance, if a candidate passed Part 1 on November 15, 2020 and then Part 2 on February 15, 2021, they have until November 15, 2023 to clear the last part or lose credit for Part 1. The same applies for Part 2: if not completed by February 15, 2024, credit cannot be awarded.

There will be paper, pencils, and calculators provided at the test site. Personal items must be stored in a locker and cannot be taken into the testing room. It is a closed book exam and no EA exam prep materials are allowed in during the test. Candidates not scheduled to take the test cannot wait in the test center. We have published a complete list of test center rules for your reference.

You cannot bring in an EA exam prep materials and food and water are also not permitted. There are three reasons for avoiding food and water in the testing room. First, it reduces the chances of cheating. Second, it avoids possible damage to computer equipment from spills. Third, it can distract other test takers. Candidates may take breaks to access the test center’s water fountain and store bottled water and food in their lockers.

A pass/fail message will appear on your computer screen. Your test score is confidential and will only be accessible by you and the IRS.

Following a scoring study, the IRS determined the scoring methodology. The scaled passing score for candidates who meet the minimum qualifications for becoming an Enrolled Agent has been determined by a panel of subject matter experts consisting of Enrolled Agents and IRS representatives. The scaled passing score is 105 out of 150 points or ~73%.

After passing the third examination part, you must apply for enrollment within one year.

Pay.gov allows you to apply electronically for enrollment and pay the $140 enrollment fee securely.

A completed Form 23, Application for Enrollment to Practice before the IRS, along with a check for $140, can also be submitted by mail.

Yes, we have money back, pass, and unlimited update guarantees.

Our pass rate is currently measured at 98% based on customer survey data.

Yes, we have money back, pass, and unlimited update guarantees.

Our ChatGPT AI EA exam tutor is available 24/7/365 to provide instant, genius level assistance. Our Pass Bot consistently scores 100% on practice exams.

Simply say, “Can you explain the correct answer?” Or, ask in any format you desire. Ask the Pass Bot to explain in more detail, show detailed calculations, or any other question you can imagine.

The Pass Bot can understand your request without confusion and minimal input, unlike most automated systems you may have experienced.

Next, it knows the context of the materials you are studying. It knows the question you’re on, the related tax code, and more.

Finally, it also knows the conversation so you can ask follow questions.

It is not. It uses cutting ChatGPT technology that has been fine tuned for the EA exam and the content within our systems. Your magic moment with our product is the first question and response you receive from our AI.

If you want to prepare for something effectively, you need to do that exact thing. You will be faced with multiple choice questions. Taking as many new practice questions as you can is the most efficient way to pass these exams.

Allowing you to constantly access new questions gives us more accurate data about your performance.

Other programs run out of questions, repeat questions, or limit the number of practice exams you can take. With such a large pool of questions we don’t experience that issue.

Like other programs we have all of the past exam questions published by the IRS along with carefully crafted new questions to provide you with the highest quality experience by always allowing you to access fresh content to study.

Yes, we give you a dynamic study plan that tracks your progress while being designed to produce maximum results in the least amount of time spent.

Yes, we offer a comprehensive study guide and bundle that is perfect for students embarking on their study journey from scratch.

Additionally, we provide a Test Bank and Practice Exam package for those seeking to supplement their studies from another course.

Yes, all products are unlimited use so you can study how you want.

Yes, we have money back, pass, and unlimited update guarantees.

Customer service and your satisfaction are extremely important to us. Please feel free to contact us anytime with any questions or comments and we will respond ASAP!

Simply come to eaexam.co anytime and click on Contact Us. We also allow you to contact us for any issues or feedback during study sessions without leaving those sessions.

You can access tons of free questions in the Test Bank, Power Notes, analytics, reporting, and even ask the AI up to 10 questions.

Free access does not expire.

Carter Harrison,

Student

I passed the EA exams easily. Having access to so many practice questions is a huge advantage. When I passed a mini exam around 80%, I would schedule my exam and pass. Amazing product.

Kate Rogers,

Student

I passed all 3 exams on my first try… I am so happy! The AI tutor was mind blowing. Whenever I was stuck or didn’t understand something, your tax genie always provided the instant learning I needed. Thank you so much!!

Lucas Montgomery,

Student

I purchased a more expensive product and then found this one. I honestly just ended up gravitating to all the practice questions here. The ability to find my weaknesses and then allowing me to drill questions around those weaknesses made a huge difference and saved tons of time. Strongly recommend!!