Individuals aiming to become an enrolled agent can expect career advancement and opportunities to offer comprehensive tax services. Regular education ensures ongoing competence.

Blog

Embark on the journey to ace the enrolled agent exams and shine in taxation. Mastering these exams paves the way to earning a respected position.

Aspiring tax professionals can access top-notch enrolled agent test preparation designed to excel. Success is yours at the EA Exam Test Bank.

Achieving the status of an Enrolled Agent requires a strategic study for enrolled agent exam approach to succeed. Consistency in studying is key to passing the exam.

Achieving the prestigious status of Enrolled Agent requires passing the Prometric EA Exam, proving expertise in tax law and readiness for IRS representation.

Master your exam prep with challenging enrolled agent test questions tailored for success. Enhance your readiness and mental agility.

Acing the Enrolled Agent exam can spark a whirlwind of anxiety, but what does it actually take to triumph over this challenge?

Imagine yourself standing before a complex maze, each pathway representing a different aspect of tax law, your mind brimming with regulations and

Are you poised to become an Enrolled Agent, the tax expert recognized by the IRS? Mastery of tax regulations is the cornerstone

All Inflation Adjusted Amounts Individuals Additional Standard Deduction – Aged or Blind Individuals $1,500 Additional Standard Deduction – Unmarried Individuals not

Summary of Rev. Proc. 2022-38 Adoption Credit Special Needs Child: Credit of $15,950. Other Adoptions: Credit up to $15,950, equal to qualified

Table of Contents Filing Deadlines for 2023 Tax / Information Returns Type of Return (calendar year) Due Date Extended Due Date Notes

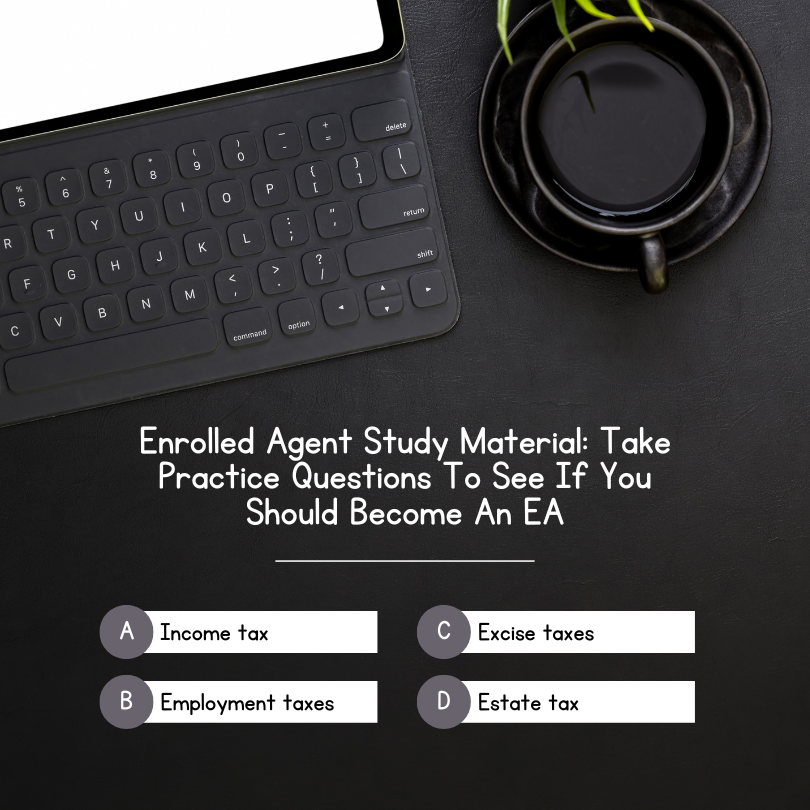

The article underscores the critical role that practice exams play in preparing with the right EA study material, highlighting their ability to

Overview of the Enrolled Agent Exam and Relevant EA Study Material Understanding the importance of effective EA study material, candidates should consider

Enrolled Agent Exam Overview Before the showdown between PassKey EA and EA Exam Test Bank begins, let’s first review the details of

Importance of Thorough Enrolled Agent Exam Prep Moreover, thorough enrolled agent exam prep ensures that individuals possess in-depth knowledge of tax laws,

How to Become an Enrolled Agent: The Role and Benefits of Enrolled Agents Learning how to become an enrolled agent is the

Introduction Passing the enrolled agent test is a crucial step for individuals aspiring to become an EA. Obtaining an enrolled agent certification

Get Your Enrolled Agent Practice Exam Free Test Bank Question Now @ EAExam.co. Introduction The Enrolled Agent (EA) exam is a comprehensive

What is an Enrolled Agent License? An enrolled agent license is a federal credential that grants individuals the authority to represent taxpayers

Introduction: Delving into Enrolled Agent Exam Questions Taking the leap to become an enrolled agent opens up a world of opportunities in

Enrolled Agent Requirements: A Comprehensive Guide Enrolled Agent Requirements Introduction An enrolled agent is a tax specialist authorized to represent taxpayers before

Imagine standing at the beginning of a labyrinth, equipped only with a map and a sense of determination. Much like a skilled

Tips for Effective Enrolled Agent Course Free Test Bank Usage To make the most of your enrolled agent course free test bank

Understanding EA Certification Enrolled Agent (EA) certification is a prestigious credential that showcases an individual’s expertise in tax matters and their ability

Many people often ask “how to become an Enrolled Agent IRS representative?” as they navigate their career paths in the tax preparation

Introduction: Become an EA The steps to become an EA are clear and highly achievable. Enrolled agents are tax professionals authorized to

How to Become an Enrolled Agent In this blog article, we will discuss the entire process for how to become an Enrolled

Preparing for the Enrolled Agent (EA) exam is no small feat. The EA designation, awarded by the IRS, is a prestigious credential

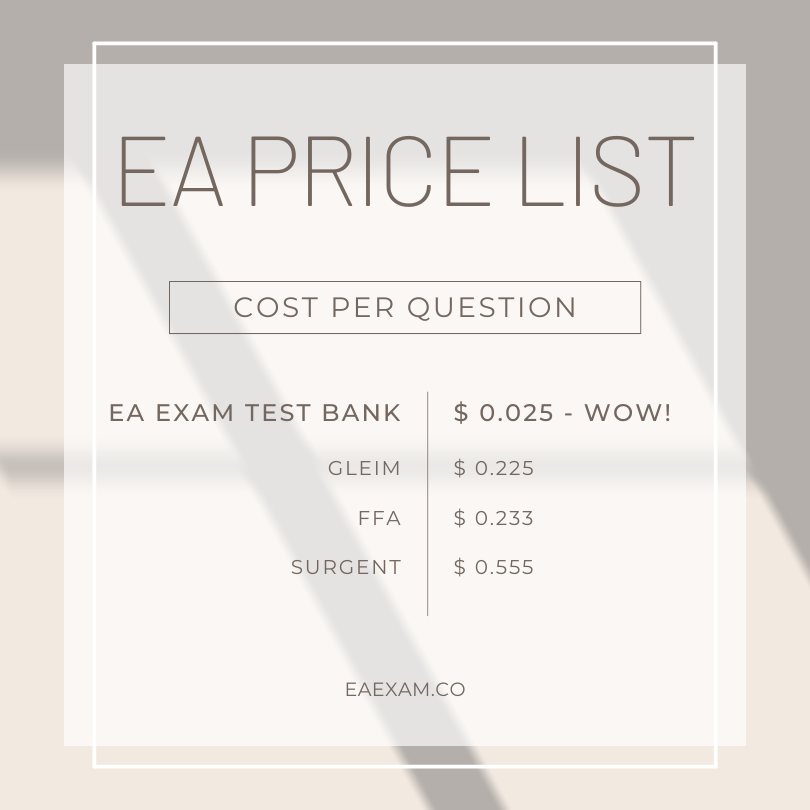

If you're looking to become an Enrolled Agent (EA), it's important to find the right EA course to help you pass the EA exam without breaking the bank.

If you're planning to take the SEE, you need to have comprehensive Enrolled Agent study material with lots of practice questions!

In this article, we'll discuss how AI can be used to create a custom EA study guide for you, based on your strengths and weaknesses.

In this article, we'll explore the advantages of using an AI-powered practice question pool compared to a traditional enrolled agent exam study guide.

AI is making it possible for students to prepare for the EA exam more effectively. Read this before you buy Enrolled Agent review materials.

Enrolled Agent jobs can be a lucrative and rewarding career choice for those who are interested in tax preparation and representation.

There are several Enrolled Agent study techniques that can help candidates pass the exam. In this article we will explore 5 techniques.

If you’re planning to become an enrolled agent, you’re probably wondering which enrolled agent course is the best fit for you. There

When it comes to studying for the EA exam, there are a variety of enrolled agent study materials available. Let's explore so you can pass fast!

We explore the benefits of using practice test questions and practice exams over a traditional enrolled agent study guide for studying to pass the EA exam.

Enrolling in an enrolled agent course is a great way to prepare for the EA Exam and earn the prestigious EA designation. But, what should you look for?

Part 3 covers EA study topics such as tax law and research, client communication, representation before the IRS, and ethics.

If you want to ace part 2 of the EA exam, you must first understand all of the EA study material domains that you will be tested on.

The IRS enrolled agent exam consists of three parts, and the first part focuses on individuals. Here are the subjects you need to dominate to pass part 1.

Your Enrolled Agent Exam Guide is a comprehensive resource to help you pass the Enrolled Agent exam with flying colors. Earn your EA designation fast!

Pass the EA exam on the 1st attempt! This blog will help explain the tactics to pass the EA exam fast and on the first attempt.

For anyone planning to take the IRS EA exam, preparing for testing day can be a daunting and stressful experience. Let's get you prepped and ready to dominate!

If you are looking to become an Enrolled Agent with the IRS, you first have to pass the special enrollment examination. Here is a list of all SEE domains.

Becoming an enrolled agent requires some EA exam prep in order to pass 3 parts of the Special Enrollment Examination (SEE). Here are the most FAQs.

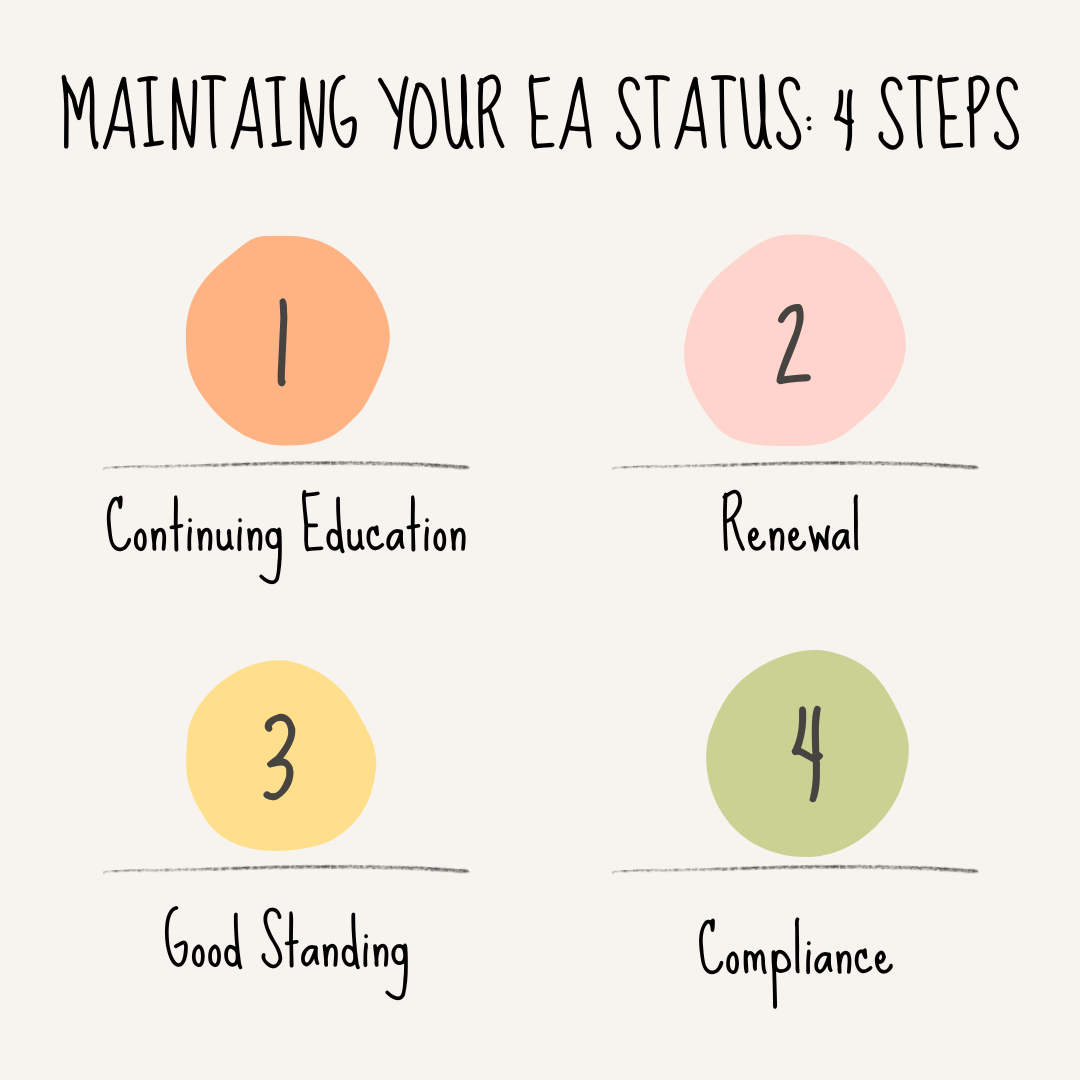

We will discuss what you need to do in order to maintain your Enrolled Agent status: continuing education, renewal, good standing, & compliance.

Are you interested in pursuing a career in taxation? Have you been considering taking the IRS Enrolled Agents exam? Discover 8 must know facts before you begin.