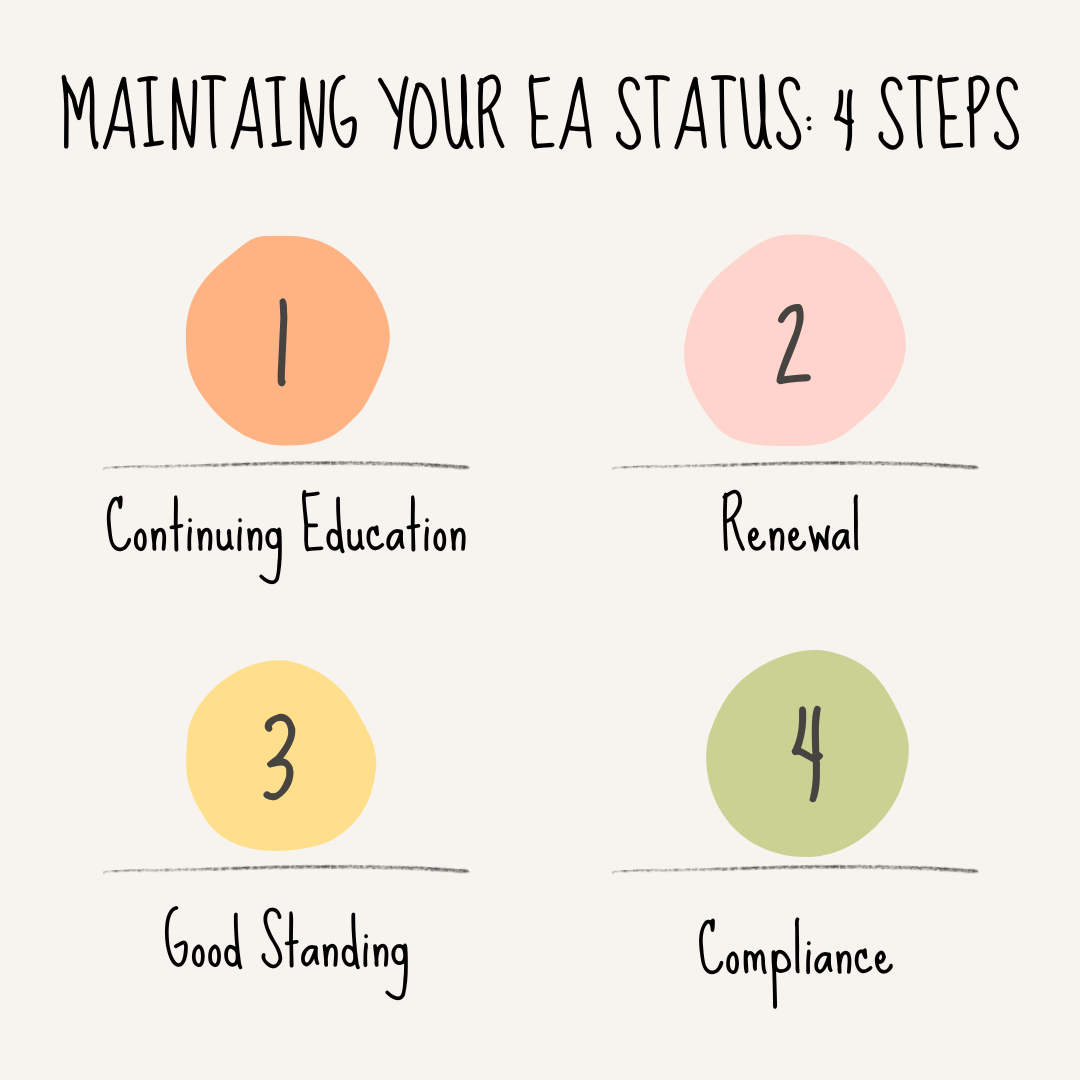

What are the requirements to retain my Enrolled Agent status?

Becoming an Enrolled Agent requires no college degree or other higher education to qualify. Once granted Enrolled Agent status after passing the EA exam, however, you cannot sit back and relax – in order to maintain it you must pass the Enrolled Agent exam and meet certain other criteria.

This blog will offer guidance on how to maintain your Enrolled Agent status, as well as tips and tricks to help you stay abreast of changes in regulations and broaden your knowledge within this ever-evolving field.

Enrolled Agent Continuing Education

Agents must complete 72 hours of continuing education each three-year period. This includes at least 16 hours on federal tax law updates annually and two hours ethics education.

As an Enrolled Agent (EA), you must complete 72 hours of continuing education every three years. This must include at least 16 hours on federal tax updates annually and two hours on ethics.

Maintaining Enrolled Agent status requires completing the necessary CE credits. Doing so ensures you remain up to date on all tax laws and regulations, as well as uphold ethical principles.

Earning CE credits can be accomplished in many ways, including attending webinars or seminars, taking self-study courses on tax topics and articles, and taking online self-study classes. It is essential that reliable information comes from trustworthy sources.

Renewal of Enrolled Agent Status

Every three years, enrolled agents must renew their registration with the IRS in order to remain active.

Enrolled agents who wish to renew their enrollment must complete and submit the IRS Enrolled Agent Renewal Application (Form 8554). By doing so, EAs attest to their good standing and ongoing education with the IRS.

Renewing your Enrolled Agent designation:

- They should apply for a Preparer Tax Identification Number (PTIN), if they do not already possess one.

- For each three-year renewal cycle, you must complete 72 hours worth of continuing education (CE). This includes 16 hours on federal tax updates, 2 hours ethics training and 10 hours tax law updates.

- They must submit their renewal application to the IRS before the renewal deadline, which usually falls on March 31st in the year following expiration of their renewal cycle.

- You must ensure your tax compliance is up to date, with timely filing and payment, and that there are no outstanding tax debts.

- If applicable, secure surety bond coverage based on the type and number of clients.

Enrolled agents should remain informed about any modifications or updates to the renewal process as regulations and standards evolve.

Maintain Good Standing

All enrolled agents must maintain good standing and adhere to all tax obligations.

As an Enrolled agent (EA) with the IRS, you must abide by Circular 230 standards of professional and ethical conduct. This sets forth how you conduct yourself when dealing with the IRS. These requirements are paramount for maintaining good standing.

Tax returns must be filed promptly and accurately, while abiding by IRS advertising/solicitation rules which include making clear and accurate claims.

Client information is kept confidential, while conflicts of interest are avoided, to guarantee clients receive up-to-date tax advice.

Enrolled Agents who violate these requirements may face an IRS disciplinary motion, including suspension or revocation of their EA status. To maintain good standing with the IRS, Enrolled Agents must understand and abide by its ethical and professional standards.

Compliance

EAs must adhere to Circular 230, which sets forth the guidelines for practice before IRS. The IRS regulates the practice of enrolled agents, or EAs.

The IRS has specific requirements for Enrolled Agents (EAs), both practicing before and maintaining enrollment. EAs must follow these guidelines to remain enrolled:

You must pay the enrollment/renewal fee and submit a completed Form 8554, Renewal Application to Enrollment in Practice Before the Internal Revenue Service.

Additionally, follow Treasury Department requirements for continuing education (CE).

These requirements may lead to IRS disciplinary action, including the potential revocation of enrollment.

Enrolled Agents meet all these criteria with dedication, demonstrating their dedication to keep their skills and knowledge current as well as providing top-quality tax services for their clients.