Become an Enrolled Agent: Step-by-Step Guide

Passing the Enrolled Agent (EA) exam opens the door to...

If you are looking to become an enrolled agent (EA), then you will need to pass the EA exam. Passing the EA exam is essential for anyone wanting to offer tax services and work as an independent tax preparer. But, how do you go about passing this exam? In this blog post, we’ll discuss the basics of the EA exams, such as the format of the exam, topics covered on the test, and helpful tips for passing it. With these strategies in hand, you can begin your journey to becoming a successful EA and providing top-notch tax services.

The IRS Publication 1, “Your Rights as a Taxpayer”, explains the rights that taxpayers have during the tax process. This is an important publication for the EA exam. The IRS Publication 556, “Examination of Returns, Appeal Rights, and Claims for Refund”, provides information on how to appeal an IRS decision or file a claim for refund. The IRS Publication 17, “Your Federal Income Tax”, is a comprehensive guide to understanding and paying your federal income taxes.

The IRS Publication 1 explains your rights as a taxpayer during the tax process, such as the right to privacy and the right to appeal an IRS decision. It also outlines what to do if you disagree with an IRS decision, how to obtain assistance from the Taxpayer Advocate Service, and more.

IRS Publication 556 is also very important for the EA exams. The IRS Publication 556 provides guidance on appealing an IRS decision or filing a claim for refund. It explains how to make an administrative appeal of an IRS decision (for example, if you disagree with a penalty imposed by the IRS), how to submit a claim for refund if the amount of taxes paid exceeds what is owed, and how to request interest on refunds that are not paid timely. It also describes procedures for making a formal dispute of any disputed amount in court.

The IRS Publication 17 covers all aspects of filing federal income taxes. It provides information on understanding your tax forms and deductions, filing deadlines, payment options, calculating refund amounts or taxes owed, and more. Additionally, it includes information about special tax situations such as marriage or divorce, self-employment income, capital gains and losses from investments, claiming dependents on your return, and other topics related to federal income taxes. Filing tax returns is very important for Enrolled Agents and will no doubt be part of your EA exam.

In conclusion, the IRS Publication 1, 556 and 17 provide information on understanding and navigating the tax process. They explain your rights as a taxpayer, how to appeal an IRS decision or file a claim for refund, and how to correctly file your federal income taxes. The material in these publications will absolutely appear in the EA exam questions for part 1.

If you want to become an enrolled agent, it is crucial that you familiarize yourself with the tax laws, regulations, and procedures that will be covered on the EA exam. The best way to do this is to use study materials such as textbooks, practice EA exams, and review courses.

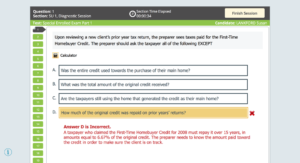

Textbooks can provide you with a comprehensive overview of the topics that will be covered on the EA exam. Practice EA exams can help you identify which areas you need to focus on studying. EA Exam Test Bank provides practice EA exams that look and operate just like the real Prometric exams while providing detailed subject analysis using AI.

Review courses can give you an in-depth understanding of specific topics. However, review courses and textbooks are usually summaries of the IRS publications. Focusing on test questions that will be covered on the EA exam is the most effective way to study and pass fast.

All of these study materials will help you prepare for the EA exam and increase your chances of passing on the first attempt.

Assuming you have already decided to become an enrolled agent and have met the qualifications, you are now ready to start studying for the EA exam. The first step is to create a study schedule and stick to it. Allot enough time to cover all the material and practice questions.

The IRS provides a list of recommended study materials on their website. Be sure to review the list and select the resources that will work best for you. There are many different ways to study for the EA exam, so find a method that works best for you and stick with it.

In addition to studying, it is important to take practice EA exams. This will help you get comfortable with the format of the EA exam and identify any areas where you need more focus. Make sure the study program you purchase allows you to see you subject by subject breakdown of your performance by subject. You should also be able to repeat and review questions you answered incorrectly. Your practice exams should also be scored like the real exam.

Once you have studied all the material and are passing practice EA exams at 80% or better, you should be ready to take the real thing. Good luck!

If you want to pass the EA exam, you need to focus on areas where you need improvement and continuously review until you have a good understanding of the concepts. The best way to do this is to use a program like EA Exam Test Bank that will pinpoint weaknesses by subject using AI. This approach is laser focused, which will save you time while dramatically improving performance. The program can be used in addition to other study materials or on its own. Additionally, make sure to review the material regularly so that you don’t forget what you’ve learned.

Finally, take practice EA exams and review the solutions. This will help you understand your weak areas and give you an idea of what to expect on exam day. Good luck!

Taking practice EA exams is a great way to gauge your understanding of the material and identify any areas that need improvement. There are a few different ways to approach this. First, you can find practice EA exams online. These can be helpful in getting a feel for the types of questions that will be on the actual EA exam.

Second, you can ask someone who has already taken the exam for their help. This can be a great way to get first-hand knowledge of what to expect and what areas you need to focus on.

Finally, your best bet is to find a study group or class that can help you prepare for the EA exam. This will give you the opportunity to work with others who are also preparing for the test.

To take the EA exam, you’ll need to visit a Prometric testing center. The EA exam consists of three parts, each covering a different area of taxation: individual tax returns, business tax returns, and representation, practices and procedures. You’ll have three and a half hours to complete the EA exam, so be sure to budget your time accordingly.

Before you can take the EA exam, you must first register for it and pay the associated fee. Once your registration is accepted, you’ll be able to schedule a date and time to take the EA exam at a Prometric testing center. You’ll also need to bring valid identification when you go in order to be admitted into the testing center.

On the day of your EA exam, arrive at least 30 minutes before your scheduled appointment time. This will give you time to check in with the testing center staff and get yourself settled before your exam begins. During the EA test, it’s important that you follow all instructions given by Prometric personnel.

Once you complete the EA Exam, your score will be available immediately after completing the test. Make sure to keep track of this information as well as any other documentation from Prometric that shows that you have taken and passed a part of the EA examination. Good luck!

If you don’t pass the EA exam, don’t worry – you can retake any part of the EA exam after waiting at least 45 days. In the meantime, use the time to review your weaknesses and strengthen your knowledge so you can pass on your next attempt.

There is no limit to how many times you can take the EA exam, but we recommend waiting at least 45 days between attempts. This will give you enough time to review your material and focus on your weak areas.

When studying for the EA exam, make sure to use a variety of resources so you can get a well-rounded understanding of the topics covered. We recommend using both publications and online practice questions to prepare for each test.

And finally, remember that practice makes perfect! The more familiar you are with the EA exam material, the better your chances of passing on your first try.

Passing the Enrolled Agent (EA) exam opens the door to...

The journey to becoming an Enrolled Agent is both challenging...

Imagine gazing at a promising future as a tax professional.However,...

Achieving the status of an Enrolled Agent is a significant...

Are you envisioning a successful career as an Enrolled Agent?It's...