Become an Enrolled Agent: Step-by-Step Guide

Passing the Enrolled Agent (EA) exam opens the door to...

An enrolled agent is an individual who is licensed to represent taxpayers before all administrative levels of the IRS. Those who pass the enrolled agent exam are eligible for this privilege. A successful passing of the enrolled agent exam is an invaluable boost to one’s career and self-esteem, and it is a significant step on the path to success.

This comprehensive enrolled agent exam study guide will take you through the entire process. Studying for and passing the enrolled agent exam can be challenging. In the end, however, there is a direct correlation between your motivation and your grade on the exam, and no amount of study tips can replace adequate preparation.

The enrolled agent exams are designed to demonstrate technical competence in tax matters in order to represent taxpayers before the IRS.

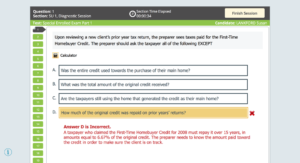

The enrolled agent exam is composed of 100 multiple-choice questions across three parts, each lasting 3.5 hours plus a 30 minute tutorial and survey. Questions come in three varieties, direct questions, incomplete sentences and “all of the following except” narratives; whatever type they take, all answers are presented in a multiple-choice format with four options available for every question. All parts may be taken as individual tests at different dates.

If an applicant passes a part of the enrolled agent exam, that passing score may be carried over for up to three years. Once the first part is passed, a three-year clock starts ticking on the remaining parts; carryover credit is lost after the three-year window expires.

It is possible to take the IRS enrolled agent exam four times between May 1 and February 28 during a 10-month window. Each part costs $203. Candidates can register online by clicking Schedule My Test at www.prometric.com/irs. During the registration process, candidates choose a time and location for the test. Prometric has approximately 300 test sites across the country. You can find more information by visiting their website and clicking on Review the Candidate Information Bulletin.

No specific educational credentials are needed to sit the enrolled agent exam, however it is assumed that candidates possess an intermediate knowledge of tax matters which is comparable to a college degree. In preparation for this test, you may choose to reference the Internal Revenue Code, Treasury Department Circular 230 as well as IRS publications, forms and their related instructions. Online versions of Circular 230, IRS forms and publications from both the current and previous years can be found on www.irs.gov/Forms-&-Pubs.

In order to pass quickly, you need to immerse your self in study questions and practice enrolled agent exams. The EA Exam Test Bank program will give you access to thousands of practice questions and exams. Every time you answer a question, the AI algorithm is learning your strengths and weaknesses, so future study sessions can be as focused as possible!

When attempting to pass the enrolled agent exam, one must remember two cardinal rules: there are no shortcuts and an organized approach is essential. A good strategy for success is to dedicate at least 50 hours of study to each part of the enrolled agent exam, spread out over 10-15 hours per week. Taking concise notes in your own words can be beneficial as they will act as a short reference guide when revisiting more complex provisions. Do not forget to leave ample time before each enrolled agent exam date to review with a practice run. EA Exam Test Bank practice exams look, operate, and are scored exactly like the real Prometric enrolled agent exams. Achieve passing scores and focus on weaknesses using AI to provide the best opportunity to pass on the very first try.

Many review courses are overpriced. If you spend $1,000 on a review course and another $1,000 on enrolled agent exam and IRS fees, it adds up quickly. Instead leverage Exam Test Bank with the largest pool of study questions, identical practice exams to the real thing, and AI to save you time, money, and stress while pursuing the Enrolled Agent (EA) credential.

Prometric’s details for grading on a closed enrolled agent exam are unclear. The number of correct answers from the total amount of questions is transformed to a range between 40 and 130, and 105 is necessary to pass by IRS rule. Presuming it’s linear with a starting point of 0, that means 65 correct answers out of 90 is the pass mark, or 72.2%.

The enrolled agent exam may not focus on intricate taxation details, but rather on more basic concepts that every practitioner should be aware of. These may include the corporate tax formula, how partnerships and S corporations distribute income, IRA’s main attributes, and deductions associated with adjusted gross income. Make sure you are prepared to answer such questions.

Here is a comprehensive list of subjects covered on the enrolled agent exam.

A thorough analysis of these categories implies that many of the questions can be answered with an understanding of fundamental concepts tested on the enrolled agent exam. Questions relating to minimization of taxes or advising taxpayers are usually rooted in basic computation knowledge. Familiarizing oneself with common adjustments and preferences for the alternative minimum tax should give one enough information to answer planning or interview questions related to this topic. In addition, having a grasp on the five tests for dependency should enable one to address any questions associated with exemption deductions.

It is necessary to cover a number of technical issues covered elsewhere in your basic studying because many of the soft topics in Part 3 relate to taxpayer representation before the IRS. A number of questions on recordkeeping and document retention requirements were included in the old enrolled agent exams, and they are probably relevant here as well.

Gaining an understanding of sound office tax protocols can provide you with the aid to respond to a lot of the initial work and preparation inquiries. A number of these queries could be answered by being acquainted with the client survey typically done at the start of an appointment, or with a client interview form, or even the interview questions that come in most tax preparation software. Professional organizations often have helpful client checklists or office practice guidelines on their sites, which can prove advantageous in preparing for such questions on the enrolled agent exam.

Rather than purchasing an enrolled agent exam review course to avoid the need to open IRS Forms & Publications, why not take a look at some of them? You could discover answers word-for-word from these sources and tap into your memory for surprising and delightful results. Not all of the materials are necessary; publication 17, Your Federal Income Tax, provides enough basic information for you to bypass more tedious, detailed topics like Publication 501’s Exemptions, Standard Deduction, and Filing Information.

It is crucial to review Publication 1345 and Circular 230 before taking the enrolled agent exam. As the use of electronic filing becomes almost compulsory, so does the prevalence of queries on this matter in the test. In addition, potential questions regarding electronic filing are also included as part of broader topics like “Accuracy” in Part 3. Both of these publications can be found on the IRS website.

You should know the different formats of tax calculations (e.g., tax formulas) well enough to save a lot of time and money in the future. There are likely to be several questions on your enrolled agent exam requiring you to (1) distinguish deductions from adjusted gross income from deductions from adjusted gross income and (2) determine whether an itemized deduction is subject to the floor of 2% of adjusted gross income;

A favorite question on the old open enrolled agent exams was to calculate the charitable deduction for corporations whose income includes gross dividend income. If you know the corporate format, you will remember that the 10% of taxable income limit for corporations is calculated on an income figure that includes the gross dividend but does not take into account the dividends received deduction.

It is very easy to distinguish ordinary income from items that must be allocated to owners if you remember the definition of ordinary income for a partnership and an S corporation. There is one thing in common among the latter items; they cannot be included in ordinary income since they may affect different partners differently.

Flow-through entities such as estates and trusts can take a distribution deduction so that the party taxed is the beneficiary who received the distribution rather than the estate or trust itself. As far as distributions are concerned, estates and trusts are in effect flow-through entities.

Prometric has taken the initiative to stay up-to-date with the ever-evolving tax landscape, making sure that candidates who plan on taking the enrolled agent exam are aware of all changes. Candidates are expected to read through the IRS SEE Candidate Information Bulletin thoroughly before going in for the enrolled agent exam.

The Affordable Care Act has been in effect since 2014, and with it, the related tax provisions. This will remain an area of focus during enrolled agent exams for the foreseeable future, since errors in credits and payments are common. For now, expect more straightforward questions; as time goes on, they may become more specific. Tax-related questions can appear in any section of the test. Additionally, they could include experimental inquiries from time to time – see below for more details.

Prometric stresses the importance of being familiar with the computerized enrolled agent exam system prior to taking the test. For your convenience, they offer a tutorial on their website that you should take advantage of, and repeat multiple times. It is also suggested that you arrive 15 minutes early to the test site in order to go through their tutorial again. This will help ease nerves and make the testing experience run more smoothly.

The software developed by Prometric is very user-friendly and quite logical. Be sure to master the calculator function as well before taking the test. EA Exam Test Bank practice enrolled agent exams look, operate, and are scored exactly like the real Prometric exams. This is by far the best way to get familiar with the entire enrolled agent examination experience while studying and leveraging AI analysis.

There is no one-size-fits-all answer – ultimately it’s up to you. Many go for taking each part separately, allowing sufficient time to prepare in between. Wherever you feel the most confident and have the most experience is the best part to take first in order to achieve a passing score, building momentum for future parts.

Do not schedule a long interval between Parts 1 and 2 if you plan on taking the enrolled agent exam one part at a time. There are a number of topics that overlap these two parts (e.g., travel and entertainment expenses, related party losses, sales of property, nontaxable exchanges), so you may be able to use what you have learned in one part in the second part.

To ensure success on the enrolled agent exam, budget your time and be sure to answer each question correctly. Make use of the flagging feature of the software for questions that you’d like to review before completing them. Allocating approximately 1½ minutes per exam question leaves almost one hour to go back over flagged questions and review the entire test. Estimate how long each question should take you; at Question 21, you should be 30 minutes in, at Question 41, you should have been 1 hour in, etc. Stick with this timeline and you will have enough time for thorough reviewing.

Studies have shown that your first instinct as to an answer is more likely to be right than a revised one, especially when it comes to multiple-choice questions. Thus, it is best to go with your gut and move on. If the answer is still unclear, you can flag it and come back later. Unless fresh insight arises later on though, stick with your initial response – it could very well be the correct one! Moreover, eliminating seemingly impossible answers increases chances of selecting the appropriate solution. The

Prometric testing software allows you to cross out answer choices you know are incorrect on the enrolled agent exam. Right-click on an option to strike it out. Right-click again to remove the strikeout. Left-click on a struck out option to select it as your response. You may strike out as many or as few items as you like.

You can also highlight text on the enrolled agent exam. To highlight text, click and drag the mouse cursor over the desired text and then click the Highlight button that appears after releasing the mouse button. To remove, click on any area of the highlighted text and click the Highlight button again.

Do not be intimidated by the “Advanced Topics” in Part 2. Many enrolled agent exam candidates harbor concerns about questions related to uncommon topics in taxation, which is understandable. However, it is important to note that only a basic knowledge of these areas are required for the enrolled agent exam. That being said, some candidates have found that they perform better on these sections than on Part 1. Part 2 may require more studying time, but the extra effort will likely increase your chances of success. Additionally, many topics previously tested on Part 1 are now found on Part 2; for instance, individual proprietorships and partnerships now appear alongside corporations and trusts.

You may know more than you think! Applying basic tax fundamentals can provide answers to a range of questions. For instance, the rules of Sec. 1031 like-kind exchanges of properties can be applied to various other scenarios, such as when a shareholder receives shares and cash in a corporate formation or alternatively they surrender old stock while receiving new stock and some cash in a reorganization. In these cases, taxable gain is limited to the ‘boot’ received – which is the non-similar property (cash) in this situation. The wherewithal to pay principle asserts that taxes should be imposed when the taxpayer is able to pay and the government can collect: this attitude can furnish answers to many tax queries and prove helpful during enrolled agent examinations.

It’s important to remember that no matter how much time and effort you put into studying, there will inevitably be a few questions where you have no clue. Some of these may be incredibly technical, coming from sources that don’t appear on any study list. Although you might feel disheartened if this happens, bear in mind that if other candidates are having the same problem, they probably won’t count it against you. Make your best guess, flag the question for later review, and move on.

Prometric states that your enrolled agent examination may include some experimental questions that won’t be graded—these are randomly distributed throughout the exam and won’t be labeled as such. This is because a “good” question is one where successful candidates answer it correctly, and those who fail get it wrong. If you see one that perplexes you, it may very well be experimental and not count against you. Worth noting, each part of the enrolled agent exam must have 85 standard questions and 15 experimental ones that won’t be scored according to test specs.

If you pass, it will just say so; if not, then you’ll receive a scaled score (between 40 and 104) and some information about whether or not you scored below, slightly below, or above the minimum accepted score.

As soon as candidates have passed all three parts of the enrolled agent exam, they can apply for enrollment. After passing all three parts of the enrolled agent exam, they must submit a completed Form 23, along with a check for $140, within one year of passing. You will have to wait a few weeks for your enrollment card, but it is well worth it! Good luck on your enrolled agent exams!

Passing the Enrolled Agent (EA) exam opens the door to...

The journey to becoming an Enrolled Agent is both challenging...

Imagine gazing at a promising future as a tax professional.However,...

Achieving the status of an Enrolled Agent is a significant...

Are you envisioning a successful career as an Enrolled Agent?It's...