Become an Enrolled Agent: Step-by-Step Guide

Passing the Enrolled Agent (EA) exam opens the door to...

The Enrolled Agent (EA) exam is a comprehensive assessment designed for tax professionals seeking to become enrolled agents and gain certification from the Internal Revenue Service (IRS). The exam serves as a crucial step in the journey of tax professionals who aim to enhance their knowledge and expertise in tax matters. By successfully passing the enrolled agent exam, individuals can earn the prestigious title of an enrolled agent, granting them the authority to represent taxpayers before the IRS. It’s advisable for candidates to incorporate Enrolled Agent Practice Exam Free materials into their study plan to enhance their exam readiness.

Becoming an enrolled agent opens doors to various career opportunities in the tax industry. Enrolled agents possess in-depth knowledge of tax laws and regulations, enabling them to provide valuable services to individuals, businesses, and other organizations. They can assist clients in tax preparation, planning, and compliance, ensuring adherence to the complex and ever-changing tax landscape.

For example, let’s consider an individual named Sarah, who has been working as a tax professional for several years. Sarah decides to pursue the enrolled agent certification to expand her career prospects and demonstrate her expertise in tax matters. By passing the IRS enrolled agent exam, Sarah becomes an enrolled agent and gains recognition as a tax expert. This not only boosts her professional reputation but also allows her to provide comprehensive tax services to her clients, helping them navigate the intricacies of tax laws and regulations.

By utilizing Enrolled Agent Practice Exam Free materials, candidates can significantly improve their understanding and application of tax laws and regulations. The Enrolled Agent Practice Exam Free platform on EAExam.co is particularly noted for its comprehensive question bank covering all sections of the exam.

Many candidates find the Enrolled Agent Practice Exam Free resources incredibly beneficial as they prepare for the actual examination. The enrolled agent exam consists of three parts: Individuals, Businesses, and Representation, Practice, and Procedures. Each part focuses on different aspects of tax law and regulations. The Individuals part assesses candidates’ knowledge of individual income tax laws, including filing status, exemptions, deductions, credits, and tax calculations. The Businesses part covers topics such as business structures, accounting methods, and tax implications for different types of businesses. The Representation, Practice, and Procedures part evaluates candidates’ understanding of IRS practices, including the examination and appeals processes, ethics, and professional responsibilities.

Utilizing Enrolled Agent Practice Exam Free materials can significantly bolster your readiness and confidence for the upcoming test. The exam is computer-based and consists of multiple-choice questions. The number of questions and time constraints vary for each part. It is important to note that the enrolled agent exam is challenging and requires a comprehensive understanding of tax concepts and regulations.

By regularly engaging with Enrolled Agent Practice Exam Free resources, candidates can identify areas of strength and weakness in their knowledge. To illustrate, let’s consider an example related to the Businesses part of the enrolled agent exam. This section assesses candidates’ knowledge of tax laws and regulations related to businesses. It covers topics such as deductions, credits, and tax implications for different business structures. Candidates are expected to demonstrate a thorough understanding of these concepts and be able to apply them to various business scenarios. By successfully passing this part of the exam, candidates prove their expertise in business tax matters and their ability to provide accurate and knowledgeable tax advice to businesses.

Earning the EA certification brings several benefits to tax professionals. Enrolled agents have the authority to represent taxpayers before the IRS, enabling them to advocate for individuals, businesses, and other organizations during tax-related matters. This designation establishes credibility and trust with clients and employers, as enrolled agents are recognized as tax experts with in-depth knowledge of tax laws and regulations.

Enrolled agents also enjoy various career advantages. The certification expands job opportunities within the tax industry, as many employers prefer to hire enrolled agents due to their specialized knowledge and expertise. Enrolled agents can work in various roles, including tax consultants, tax advisors, tax preparers, and tax compliance specialists. These roles often come with higher earning potential and increased job security.

For example, let’s imagine a tax consulting firm that is looking to hire a tax professional. The firm receives resumes from several candidates, but they prioritize those who have earned the enrolled agent certification. This preference is due to the assurance that enrolled agents possess the necessary knowledge and expertise to handle complex tax matters. By hiring enrolled agents, the firm can provide high-quality tax services to its clients and maintain a competitive edge in the market.

Enrolled Agent jobs are always in demand. The Enrolled Agent Practice Exam Free resources are essential for anyone looking to familiarize themselves with the exam format and question types.

The real-time feedback provided by some Enrolled Agent Practice Exam Free platforms is invaluable for understanding complex tax concepts. Practice exams play a vital role in preparing for the enrolled agent exam. They serve as a valuable tool to improve exam performance and readiness. Practice exams allow candidates to assess their knowledge, identify areas that require further study, and familiarize themselves with the exam format and question types. By simulating real exam conditions, practice exams help build confidence and reduce test anxiety.

Candidates often praise the realistic simulation of the exam environment provided by the Enrolled Agent Practice Exam Free materials. To understand the importance of practice exams, let’s consider an example. John, a tax professional, is preparing to take the enrolled agent exam. He has been studying the relevant tax laws and regulations but wants to gauge his preparedness before the actual exam. John decides to take a practice exam to assess his knowledge and identify any weak areas. During the practice exam, he realizes that he struggles with certain topics, such as business tax deductions. This prompts John to focus his study efforts on these areas, ensuring that he is well-prepared for the actual exam. Without the practice exam, John may not have been aware of his knowledge gaps and may have faced difficulties during the real exam.

Tackling the Enrolled Agent Practice Exam Free questions daily can significantly contribute to your exam success by enhancing familiarity with the exam format.

The Enrolled Agent Practice Exam Free resources on EAExam.co are recognized for their quality and resemblance to the actual exam questions. There are several reliable sources where candidates can find free enrolled agent practice exams. The IRS provides resources and sample questions that can be accessed on their official website. These resources are specifically designed to help candidates familiarize themselves with the exam format and assess their knowledge of tax concepts and regulations. Additionally, reputable websites specializing in tax education and exam preparation often offer free practice exams to help candidates assess their knowledge and readiness for the enrolled agent exam.

To make the most of practice exams during exam preparation, it is important to incorporate them strategically into your study routine. Set specific goals for each practice exam session and manage your time effectively. Use practice exams as a diagnostic tool to assess your strengths and weaknesses, and focus on areas that require further study. After completing a practice exam, review the answer explanations provided and understand the rationale behind each correct answer. This will help deepen your understanding of the material and improve your performance on the actual exam. Scheduling time to review and understand the explanations for answers on the Enrolled Agent Practice Exam Free materials can deepen your understanding of tax laws.

The Enrolled Agent Practice Exam Free resources are essential for anyone looking to familiarize themselves with the exam format and question types. For example, let’s say you are studying for the Representation, Practice, and Procedures part of the enrolled agent exam. After completing a practice exam, you notice that you struggled with questions related to the examination and appeal procedures. In response, you allocate more study time to these topics, reviewing relevant IRS publications and seeking clarification on any confusing concepts. By using practice exams as a tool for self-assessment and targeted study, you can strengthen your knowledge and improve your performance on the actual exam.

By utilizing Enrolled Agent Practice Exam Free materials, candidates can significantly improve their understanding and application of tax laws and regulations. It is also beneficial to track your progress over time by taking multiple practice exams throughout your exam preparation journey. By comparing your scores and identifying areas of improvement, you can adjust your study plan accordingly. Additionally, consider timing yourself during practice exams to simulate the time constraints of the actual exam. This will help you manage your time effectively and ensure that you can complete all the questions within the allocated time.

Multiple choice questions are a significant component of the enrolled agent exam. To excel in this format, it is important to employ effective strategies. Carefully read each question and analyze the context to understand what is being asked. Pay attention to keywords and phrases that can provide clues to the correct answer. If you are unsure about an answer, use the process of elimination to eliminate incorrect options and increase your chances of selecting the correct one. Familiarize yourself with relevant tax laws and regulations to apply them effectively when answering questions. Finally, manage your time wisely during the exam to ensure you have sufficient time to answer all questions and avoid rushing. By analyzing the answer explanations provided in the Enrolled Agent Practice Exam Free materials, candidates can understand the rationale behind each option in multiple choice questions, improving their problem-solving skills.

For instance, let’s consider a multiple-choice question that asks about the tax implications of a specific business expense. By carefully reading the question and identifying keywords, such as “deductible” and “ordinary and necessary,” you can narrow down the options and eliminate choices that do not align with these requirements. Additionally, by familiarizing yourself with the relevant tax laws and regulations, you can confidently select the correct answer that aligns with the specific tax rules. Engaging with the Enrolled Agent Practice Exam Free resources allows candidates to develop a systematic approach to answering multiple choice questions, a skill that will be invaluable on exam day.

Another effective strategy for multiple choice questions is to approach them systematically. Start by reading the question carefully, ensuring that you understand what is being asked. Then, review each option and eliminate any choices that are clearly incorrect. Next, analyze the remaining options and consider the context of the question to determine the most appropriate answer. It is important to avoid making assumptions or overthinking the question, as these can lead to incorrect answers. By applying a systematic approach, you can increase your chances of selecting the correct answer and improve your overall performance on the enrolled agent exam. Through consistent practice with the Enrolled Agent Practice Exam Free materials, candidates can learn to avoid common pitfalls, such as overthinking or misreading questions, in the multiple choice section of the exam.

The Enrolled Agent Practice Exam Free platform on EAExam.co is particularly noted for its comprehensive question bank covering all sections of the exam. Practicing with sample questions is highly beneficial for enrolled agent exam preparation. Sample questions help candidates become familiar with the structure and format of the exam. By regularly practicing with sample questions, candidates can improve their critical thinking skills, enhance their understanding of tax concepts, and develop the ability to apply their knowledge to real-world scenarios. Sample questions also serve as a valuable self-assessment tool, allowing candidates to gauge their progress and identify areas that require further study and review.

For example, let’s imagine you are studying for the Individuals part of the enrolled agent exam. By practicing with sample questions related to individual income tax, you can reinforce your understanding of key concepts, such as filing status and deductions. You can also evaluate your ability to apply these concepts to different scenarios, ensuring that you are well-prepared for the exam. Regular practice with sample questions not only enhances your knowledge but also builds your confidence in tackling exam questions. Many candidates appreciate the Enrolled Agent Practice Exam Free materials as they provide a cost-effective way to assess their preparedness for the real exam.

In addition to enhancing knowledge and critical thinking skills, practicing with sample questions can also improve time management during the actual exam. By regularly exposing yourself to exam-like questions and practicing under timed conditions, you can develop a sense of pacing and ensure that you can complete all the questions within the allocated time. This can help reduce test anxiety and increase your efficiency during the exam. The insights gained from attempting the Enrolled Agent Practice Exam Free questions are invaluable for highlighting areas that need further study.

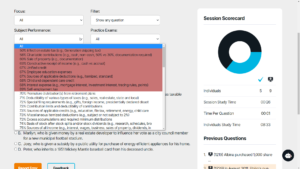

The EA Exam Test Bank is a comprehensive resource that offers a wide range of practice exams for the enrolled agent exam. It provides an extensive question bank covering all sections of the exam, allowing candidates to customize quizzes based on their specific needs. The EA Exam Test Bank offers a realistic testing experience by closely resembling the actual exam in terms of difficulty level and question format. A daily routine of attempting questions from the Enrolled Agent Practice Exam Free resources can be a game-changer in achieving a passing score.

It’s advisable for candidates to incorporate Enrolled Agent Practice Exam Free materials into their study plan to enhance their exam readiness. By using the EA Exam Test Bank, candidates can gain exposure to a wide range of exam-like questions and receive immediate feedback on their performance. The detailed answer explanations provided by the EA Exam Test Bank help candidates understand the underlying concepts and reinforce their understanding of tax laws and regulations. This comprehensive preparation tool ensures that candidates are well-prepared and confident when taking the enrolled agent exam.

For instance, the EA Exam Test Bank offers a variety of practice exams that cover all sections of the enrolled agent exam. Candidates can choose to focus on specific sections or take comprehensive exams that cover all topics. By customizing their quizzes, candidates can target their weak areas and reinforce their knowledge in those specific topics. The EA Exam Test Bank also provides detailed analytics, allowing candidates to track their progress and identify areas that require further attention. This valuable feedback helps candidates fine-tune their study plan and improve their overall exam readiness. The Enrolled Agent Practice Exam Free resources offer a realistic testing experience, aiding in reducing exam anxiety and building confidence.

Reviewing the detailed answer explanations provided in the Enrolled Agent Practice Exam Free materials can deepen candidates’ understanding of complex tax concepts. In addition to practice exams, there are various resources available to aid in enrolled agent exam preparation. Enrolled Agent study guides, textbooks, and online courses specifically designed for the enrolled agent exam can provide comprehensive coverage of the exam topics and help candidates deepen their understanding. It is beneficial to utilize a variety of resources to gain different perspectives and reinforce key concepts.

Study guides and textbooks offer in-depth explanations of tax concepts and regulations, providing candidates with a solid foundation of knowledge. These resources often include examples and case studies that help illustrate complex concepts and facilitate better understanding. Online courses, on the other hand, offer interactive learning experiences and provide opportunities for candidates to engage with instructors and fellow students. These courses may include video lectures, practice quizzes, and discussion forums, allowing candidates to learn at their own pace and ask questions when needed.

Additionally, seeking guidance from enrolled agent professionals can provide valuable support and insights during the exam preparation journey. Enrolled agents who have already passed the exam can share their experiences and offer tips and advice for success. Joining study groups or online communities dedicated to enrolled agent exam preparation can also provide a sense of camaraderie and support, allowing candidates to exchange knowledge and resources.

With the availability of Enrolled Agent Practice Exam Free resources, preparing for the enrolled agent exam has become more accessible and less daunting for aspiring tax professionals. Preparing for and passing the enrolled agent exam is a significant milestone for tax professionals seeking to enhance their career prospects and demonstrate their expertise in tax matters. Practice exams play a crucial role in exam preparation, helping candidates assess their knowledge, identify areas for improvement, and build confidence. By utilizing free enrolled agent practice exams, implementing effective study strategies, and leveraging additional resources, candidates can enhance their exam preparation and increase their chances of passing the enrolled agent exam.

Embark on your exam preparation journey with confidence and determination, knowing that you have the necessary tools and resources to excel in the enrolled agent exam. Regular practice with enrolled agent practice exams, combined with targeted study and the use of supplementary resources, will strengthen your knowledge and enhance your exam performance. Remember, passing the enrolled agent exam opens doors to various career opportunities and establishes you as a trusted tax expert. With the right preparation and dedication, you can achieve success in the enrolled agent exam and embark on a rewarding career in the tax industry.

The Enrolled Agent Practice Exam Free resources are a boon for candidates aiming to excel in the real exam without incurring extra preparation costs. Taking advantage of the Enrolled Agent Practice Exam Free materials allows candidates to gauge their understanding of the extensive tax regulations and laws. A consistent practice routine using the Enrolled Agent Practice Exam Free questions can significantly enhance a candidate’s speed and accuracy in answering.

Passing the Enrolled Agent (EA) exam opens the door to...

The journey to becoming an Enrolled Agent is both challenging...

Imagine gazing at a promising future as a tax professional.However,...

Achieving the status of an Enrolled Agent is a significant...

Are you envisioning a successful career as an Enrolled Agent?It's...